Introduction to the Variance Risk Premium

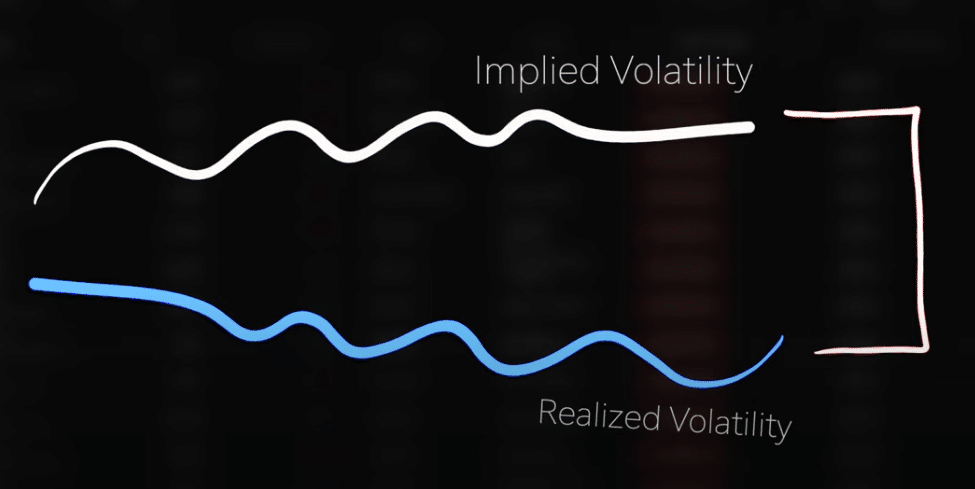

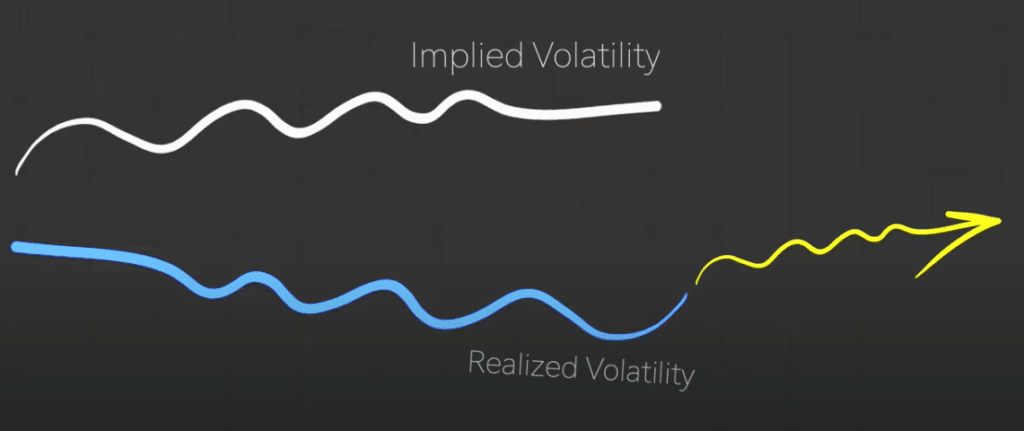

The variance risk premium is the observed historical difference between implied and realized volatility. In simpler terms, it’s the premium options trade at above their fair value. Selling options can be a profitable strategy because they offer buyers unlimited profits and limited downside. This attractive return profile means the person selling the option demands a risk premium. Volatility traders capitalize on the difference between the implied and realized volatility. Historical data suggests that betting on higher implied volatility than what is realized by the stock has been consistently profitable.

Note: Are you interested in receiving real time option premium reports from us? Click here to join our mailing list and get trade reports straight to your email PLUS our option selling guide (for free).

The Allure of Volatility Trading

Options have always held an appeal for buyers due to their potential for unlimited profits coupled with limited downside. This unique profit structure means that those on the selling side, or those writing the options, will generally demand a risk premium to compensate for the potential risks involved.

Volatility trading doesn’t focus on the direction of the market. Instead, it revolves around the difference between implied and realized volatility. The return of a direction-neutral option structure, when selling options, translates directly into profits. These can be captured through straddles, strangles, or hedged options.

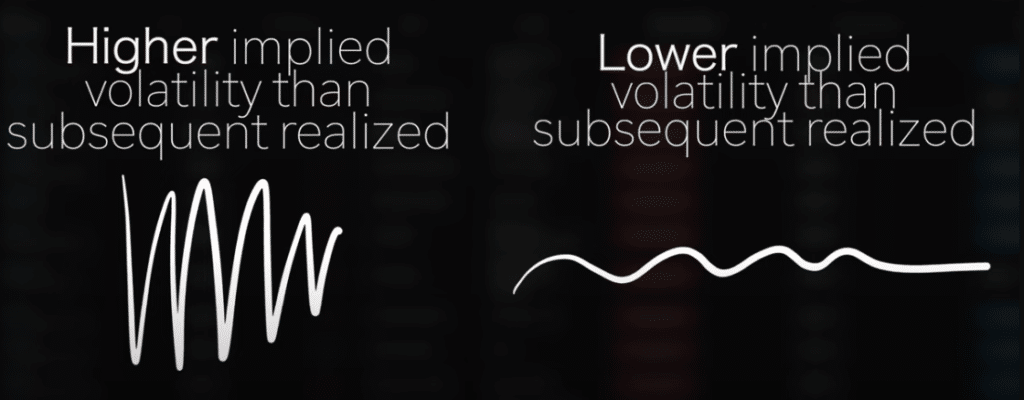

Volatility traders will sell options when they believe that the amount of stock movement implied in option premiums (implied volatility) will be higher than how much the stock is actually going to move (realized volatility). They buy options if they think that the stock is going to move more than the movement implied in option premiums (implied volatility) will be lower than how much the stock is actually going to move (realized volatility).

Historical patterns suggest that markets often project a higher volatility than is eventually realized, providing an opportunity for significant returns for those equipped to capitalize on this difference.

Tips to Profit from the Variance Risk Premium

1. Embrace the Risk

Just as equities come with an inherent risk premium due to their unpredictable nature, so does the variance risk premium. It’s not merely a matter of taking advantage of mispricings. It’s a game of understanding potential market shifts and being prepared for adverse changes. This involves identifying and evaluating potential sources of risk, and then determining whether these risks are priced fairly. To truly earn from the risk premium, one must be willing to face and manage the inherent risks.

2. When in Doubt, Size Down

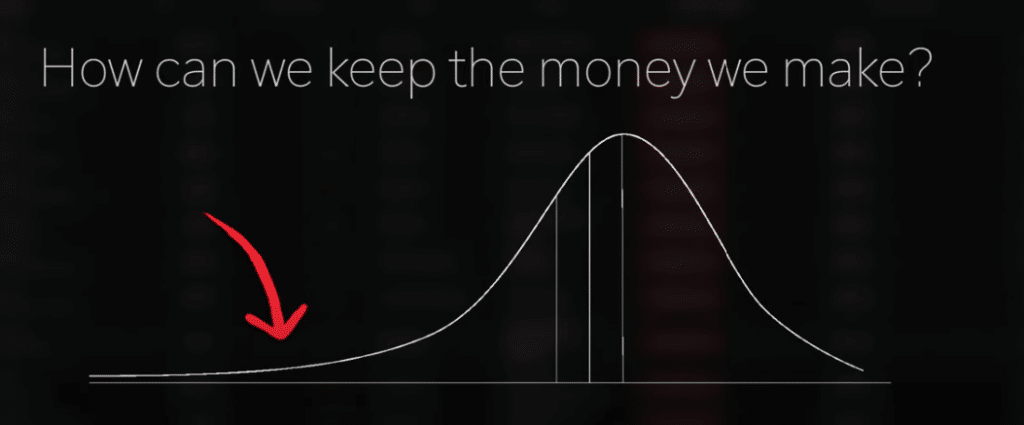

Properly sizing your trades is one of the key differences between success and failure. Imagine starting with a $10,000 portoflio. A loss of 30% would require an over 40% gain just to break even. As such, it’s essential to adjust the size of your trades based on how much the underlying stock could move. Using tools that help you develop trading plans (where to take profits, cut losses) and see the potential outcomes of decisions you make is essential.

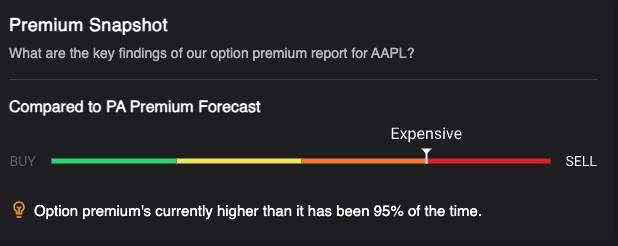

3. Scan for the Best Trades

In the end of the day we all just want to find good trades. In options, the way you do this is by using tools that help you look for mispriced options where the premium is inflated toa point that selling them becomes very lucrative. The best way to do this is by scanning for a spread between the current option premiums and a good statistical forecast of future option prices. When you combine this with a quaitative analysis of what is happening in the market and around a ticker, you are able to put together a very good plan and run a great trading portfolio. Built into the PA terminal are 10 scans that you can use today to start finding the best trades for a wide range of strategies.

Practical Application: A Step-by-Step Walkthrough

Now that you have some tips, here are the practical things you can start doing today.

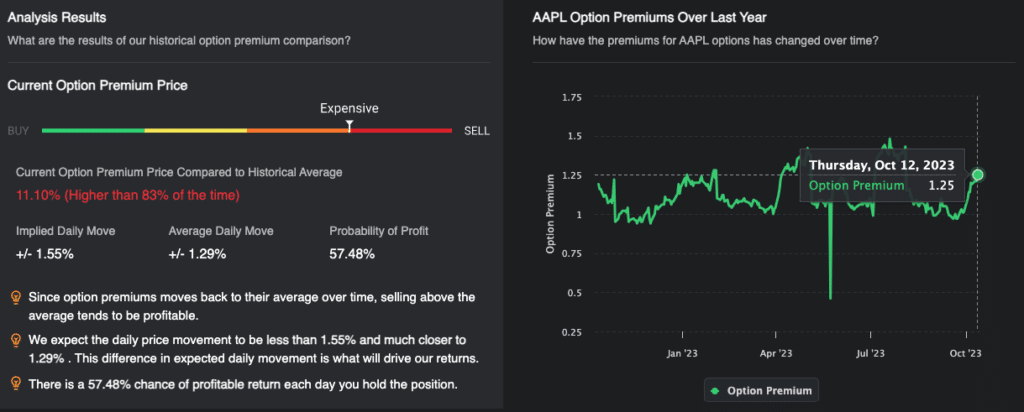

1. Try to forecast volatility instead of trading blind: Utilize a blend of tools, models, and historical data to predict future volatility accurately. A combination of implied volatilities, realized volatility, and broader market volatility measures can offer the most holistic forecast. We try to help traders by providing access to our forecasting models and premium pricing summaries (see the example below).

2. Compare Current Premiums to Historic Premiums: Option premiums have a characteristic called mean reversion. This means that when they go high, they tend to come down, and when they are low, they tend to come back up. This happens because of the laws of supply and demand. So by conducting a historical analysis, like the one below, you are able to really understand if options are cheap or expensive, and what the right trade to take is. Note: This should be part of the analysis that goes into your option premium forecast in step 1!

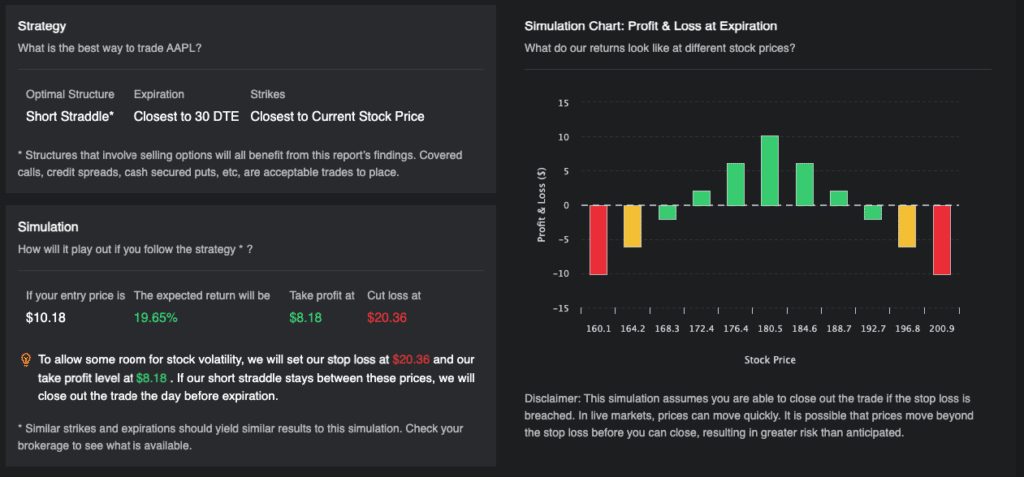

3. Price the Options and Simulate Your Trades: Use all the work you did in steps 1 and 2 to create a simulation of how your trade will go. This includes predicting your profit, probability of making money, where you will cut losses (risk management) and knowing the optimal way to capture the opportunity (straddles, covered calls, etc).

4. Trade Execution: To make sure that you extract every single dollar of potential profit, you need to be very smart when it comes to executing your trades. Don’t just hit the bid if you are selling options. Start with the ask price and work your way down. Know the lowest you are willing to go. Don’t be in a panic to exit trades, take your time and get the best fill possible. every dollar you save here is truly a dollar you earn.

Conclusion: The Sustainable Edge of the Variance Risk Premium

The variance risk premium, despite its inherent risks, presents a consistent and sustainable trading advantage. The key is understanding that it’s not just about making money but also safeguarding it. Whether you’re providing value by offering others a means to hedge their investments or by speculating on stock directions, mastering the intricacies of the variance risk premium can lead to consistent profits, even when the market throws a curveball.

Want professional option premium reports that are customized for option sellers? Join our email list and get reports sent to you every week for free.