I found a trade that should earn a 2% return on margin in 37 days.

I noticed this opportunity during my daily expensive options scan. Here’s my analysis of this trade.

What is COP?

ConocoPhillips is an American multinational energy corporation in the oil and gas industry. The company is one of the world’s largest independent exploration and production (E&P) companies based on production and proven reserves.

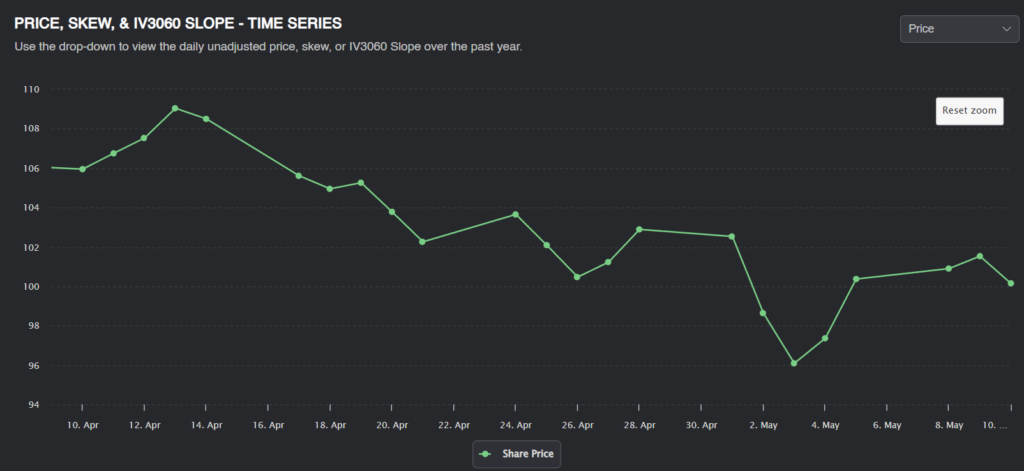

Here’s how the stock has been moving recently:

The stock has been gently falling over the last month. This price action might incentivize investors to buy puts for protection or to speculate.

While there is a trend to the downside, COP is down less than 5%, even though options markets are implying a 2.11% move every day. The stock has averaged a 1.73% daily move in either direction, but several up moves have helped stem the losses this month.

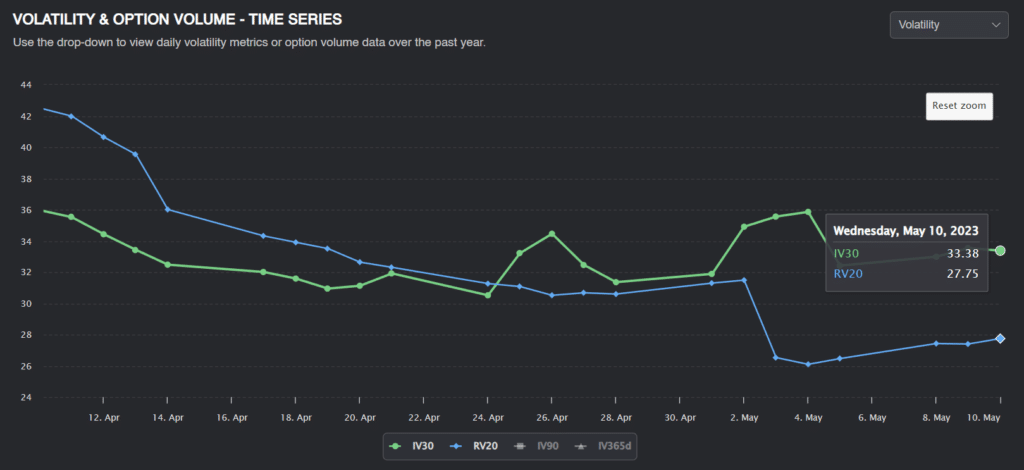

Volatility has steadily fallen, but IV remains flat; this could be an opportunity to sell temporarily expensive options.

COP’s volatility risk premium is pretty small, but it’s risen quite a fair bit recently. This could be a good short-term trade.

Relative Value Analysis

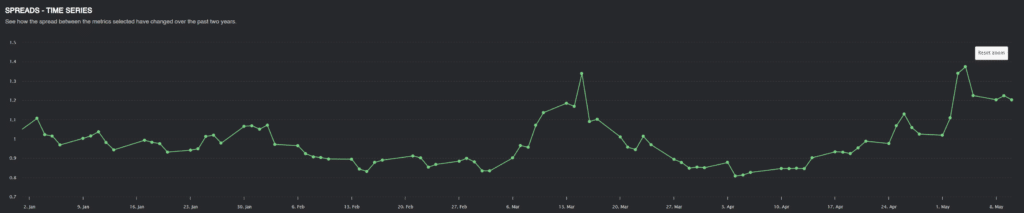

While we’ve seen that COP implied volatility looks high relative to historical volatility, we can go one step further and compare the implied volatility of COP to options prices of similar, correlated companies.

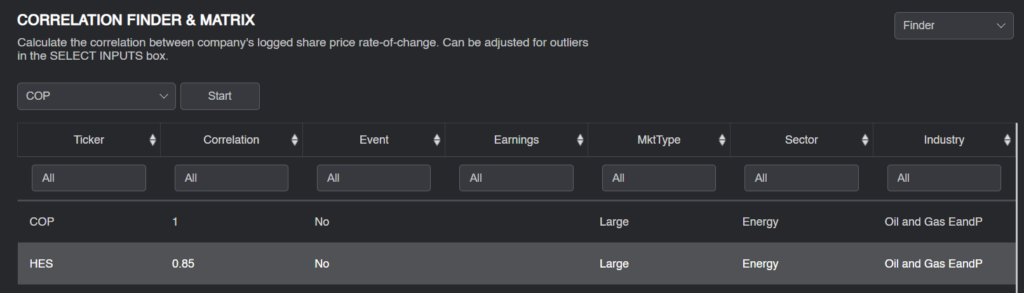

A quick scan using the correlation finder tells us that HES is an excellent candidate.

HES is a similar large-cap energy stock with a high correlation to COP. Because these companies are so similar, we could reasonably expect the IV/RV ratios of the two stocks to be similar. Since they are both large-cap energy companies, events that cause one stock to become volatile would likely affect the other as well.

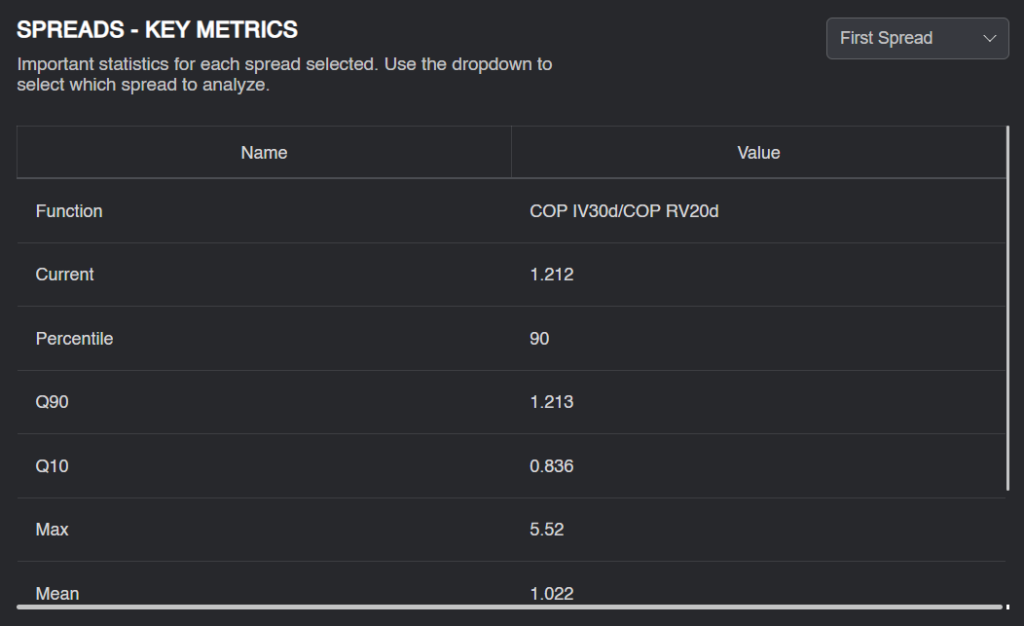

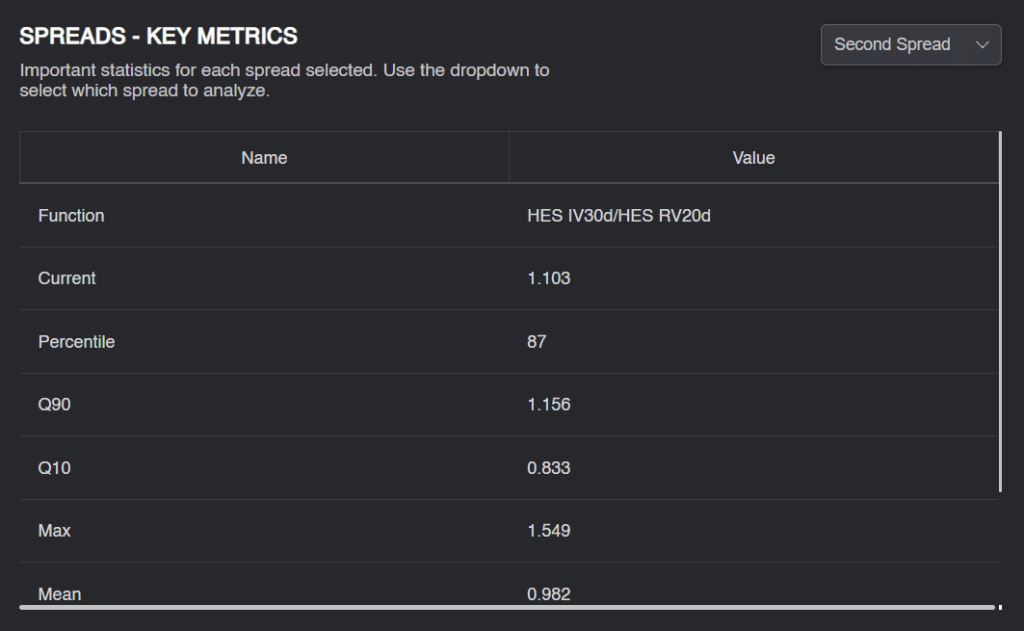

A quick look at the key metrics confirms that COP and HES have similar IV/RV Ratios on average.

Cop has a mean IV/RV of 1.02.

Meanwhile, HES has a similar mean of 0.98.

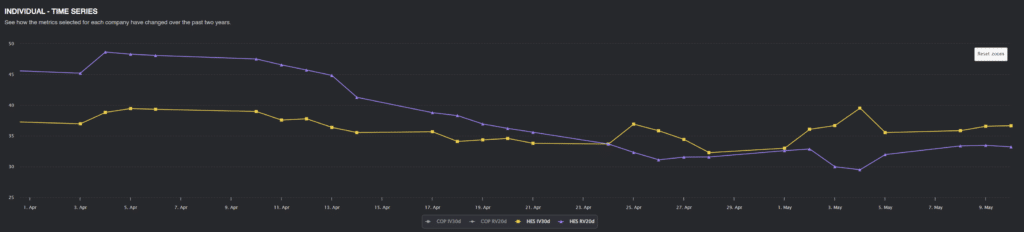

We’ve previously noted that realized volatility for COP fell recently. However, HES volatility has remained fairly consistent.

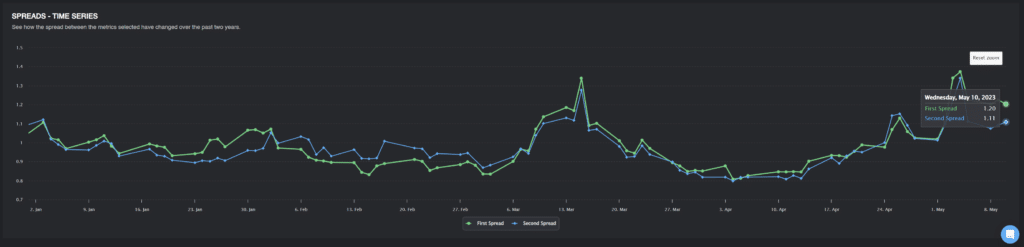

This has led HES (Blue) to have an IV/RV ratio that’s noticeably less than COP’s (Green) ratio.

For the IV/RV spread to close, COP RV should rise, or HES RV should fall. Of course, COP IV could also drop.

Forecasting Volatility

We’ve established that COP options are likely overpriced. As good traders, though, we want to price these options and quantify how large our edge is.

I will do this by taking a blend of 3 things:

- The PA forecast of volatility (A blend of IVs and RVs)

- The RV which would bring COP’s IV/RV ratio in line with HES (1.1)

- The RV where COP’s IV/RV ratio would be at its 1.02 Average

PA Forecast: 23.99

RV of COP at a 1.1 IV/RV Ratio: 30.52

RV of COP at 1.02 IV/RV Ratio 27.75

The average of these three estimators is 27.4%

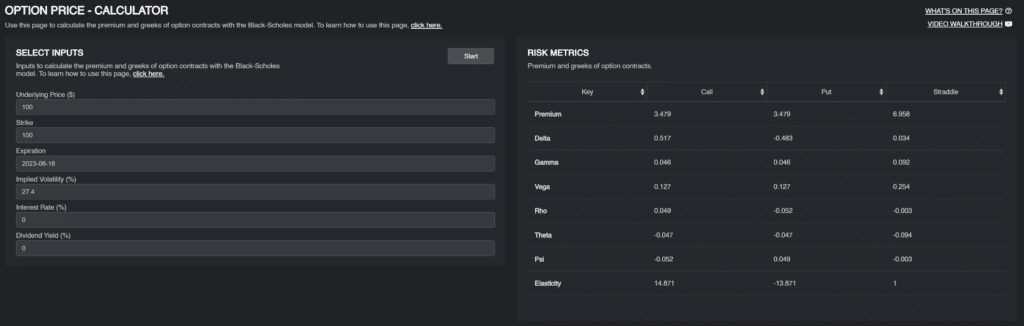

We can use the average of these estimates to price the “fair value” of the ATM straddle.

At the current IV of 33.88, the June monthly $100 straddle would cost $8.6.

At a 27.4 implied volatility, the straddle would only be worth just over $6.9 (nice).

From our analysis,, the straddle seems to be overpriced by around $130. The straddle requires 5,200 in margin (and probably a little more for delta hedging. A return of $130 on even 6,500 in margin is still a 2% return on margin over about 37 days.

Position Sizing and Management

As for position management, I would continue to hold this trade if COP realizes less volatility than implied. If we start to see multiple days in a row of outsized moves, I would cut the position early, even at a loss. Of course, if implied volatility drops, we can get out once the edge is gone.

COP’s daily implied move is 2.11%, so I would close the trade for a loss if I see significant moves above that level.

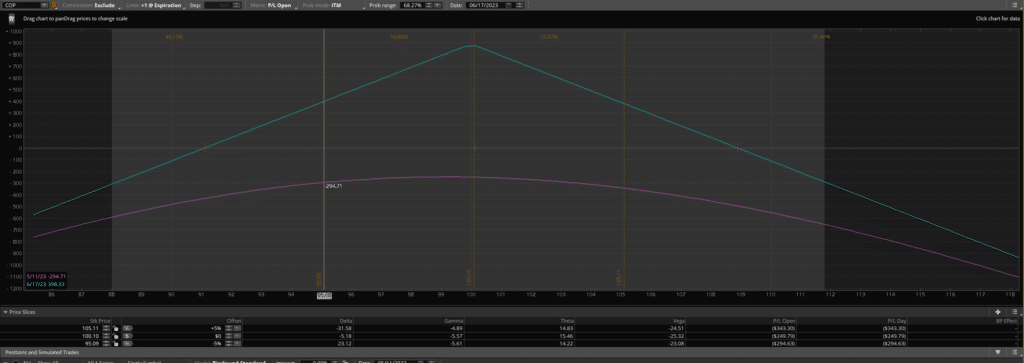

Here’s what the straddle looks like in TOS. If IV increases by 10 points tomorrow and the stock drops 5%, we will lose around $300. That’s not bad, considering that’s our worst-case scenario.

This is just another part of a short volatility book, but with some good research to back it ( when you build a book of trades like this, you do pretty well). The research is solid, but the edge that it gives us is not enough for “Let’s yolo our life savings.”

Trade it small, and find many similar trades to spread your risk!

Good luck, and happy trading.