This post goes over how I think through my trades.

I wanted to share this trade because the edge was clear, and it’s a good example to learn from. However, we need to start from the beginning to understand how to think through trades like these.

I’ll give you the context for this trade – the research I’ve done and the things I learned that helped me spot this trade.

Then, I’ll walk through the trade analysis that made me realize I found a good trade.

I’ll also discuss how I structured, sized, and managed this trade.

The Trade Opportunity

It’s May 18th, and TGT just announced earnings earlier this morning.

While the options markets expected a 6% move, TGT fell almost 25% after the earnings announcement.

Markets were spooked.

Post Earnings Implied Volatility Was Extremely High.

Because TGT moved so much, we didn’t see the usual “IV Crush” that happens after most earnings announcements. In fact, implied volatility even went up! It seems like the markets were pricing in persistent volatility despite the fact that the earnings event was over.

Looking at the volatility cone, we can see that the highest IV30 has ever been is about 46.2%. We are currently at 45.8%, near all-time highs!

Of course, just looking at implied volatility isn’t enough – we can still buy options when IV is at all-time highs if we think the stock is about to Gamestop. Our expectation of future realized volatility is just as important as implied volatility.

While TGT made a huge move right after the earnings announcement, we can assume that TGT won’t stay this volatile – the move was only a reaction to shitty earnings. There are fears that bad Costco earnings could drag down TGT’s stock price in the future, but after WMT and TGT’s earnings, I think this possibility should already be somewhat priced into the stock. Even if Costco’s earnings are horrific, it’s unlikely for TGT to realize 46% volatility or more.

Here I look at TGT’s historical volatility with earnings volatility removed. It’s labeled Non-Event Realized Volatility (NERV) in the chart below:

We can see that TGT only realized about 35% volatility in the 30 days leading up to earnings. It’s likely that after the earnings event, TGT volatility will revert back to that level or lower.

Shorting The Stock: Post Earnings Announcement Drift

Post Earnings Announcement Drift (PEAD) is a well-known market anomaly: stocks with bad earnings tend to continue downward after the announcement. Euan Sinclair discusses this in his book Positional Options Trading. Shorting stocks after disaster earnings is generally a profitable trade. We can work this into our trade by tilting our delta position a little negatively.

Another factor to consider is that stocks tend to be more volatile on the way down and are calmer on the way up. Since I’m going to be short volatility, TGT’s stock price falling will hurt my position (since volatility will increase), so being short the stock will also serve to hedge that effect.

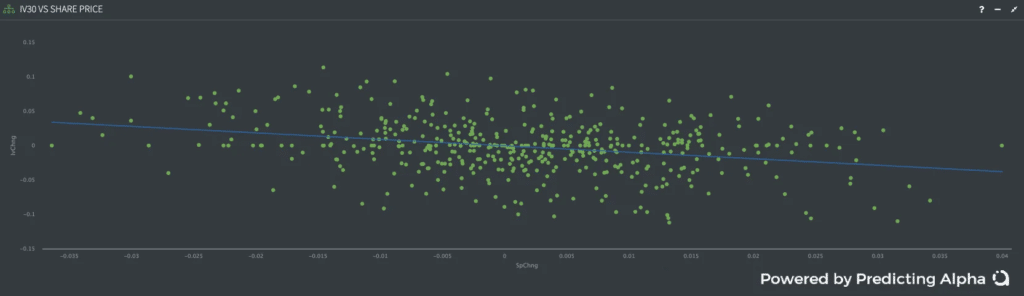

TGT’s IV increases as the stock price falls

Structuring the Trade

I want a short volatility trade with some short delta based on my research. I decided to sell an ATM straddle to get the short vega position that I wanted and then short several shares of stock so that I would have some negative delta.

Why Not Just Sell Calls?

I decided that I didn’t want to sell naked calls. I wasn’t as concerned with the risk since I wasn’t going to sell too much, but they required too much margin. Straddles would double my vega for just a little more margin.

I Could Have Sold Call Spreads

Looking back, I could have sold call spreads. I initially decided against it because I thought buying OTM calls would generally be expensive and reduce my vega exposure. Short call spreads would also become long gamma if they became ITM.

However, another experienced trader pointed out that OTM calls would actually be quite cheap after a big drop in the stock price, since the market would expect stock volatility to decrease if the stock price recovered. Selling several 50/30 delta call spreads would have also gotten me a short volatility, short delta position with a bonus of hedging with relatively cheap OTM calls. This would have allowed me to put on a bigger position safely.

Selling The Straddle

When I placed the trade, TGT was at $165, and IV was at 46. I was also short five shares of the stock. I collected a credit of ~$1750 per straddle for this trade.

To insulate myself from broader market volatility, I initially considered buying SPY vol as a hedge. However, since I’m not trading a large position, I figured that hedging market vol wasn’t worth eating the extra transaction costs and generally overpaying for SPY options.

I’m also really lazy.

However, if I was selling lots of straddles or selling straddles on many different stocks, I would strongly have reconsidered buying that SPY straddle.

Of course, this would have been less of a problem if I had sold call spreads.

Expected PnL

Since realized volatility (excl earnings) was about 35, I expected TGT volatility to fall towards that level. I would close this trade when IV fell to 40 (just to be safe), at which the straddle would be about $1450; this means I would make a profit of about ~$300 per straddle. If IV shot up to 60 (I’m being extremely conservative here; 60 would be 10+ pts above ATH vols), I would only lose $500 per straddle.

I’m also short the stock, but since stocks typically crash down and not up, my short stock hedges my short straddle and smooths out my PnL. The times when I’m losing money from vols increasing will probably be when TGT’s stock price is crashing – which is good for my short position.

Position Sizing

There are three different factors I’m considering when sizing my trade:

- This trade has a good chance of success.

- The win/loss ratio is pretty decent, even with conservative loss estimates.

- Most of my other trades at the moment are also uncorrelated with this one.

With these factors in mind, I decided to size my trade a little larger.

The rest of this trade will be delta hedging and either closing my trade at my profit target or if I realize my analysis is wrong.

Results

I started off this trade pretty badly, to be honest. I screwed up the trade execution and was down about $60 per straddle from the get-go. However, I managed to slap on the proper position by market close on May 18.

Within the first two days, TGT fell by $10. I think the price fell by 5% or something like that on May 19. I lost a little on gamma since the stock fell so much, but at least I was short the stock.

By the morning of May 20, TGT’s stock price was $155, and implied volatility was 42. I decided to roll my straddle; buying back the $165 straddle and selling a new one at the $155 strike. This is because ATM straddles have the most gamma and vega, and I didn’t want exposure to the skew (options have different IVs at different strikes).

IV continued to fall throughout the day, and I closed my entire position near market close. The final IV was just below 39.

Total Profit: $277 per straddle. Not bad, considering I messed up and had to roll my initial straddle.

Conclusion

This trade was made possible by Predicting Alpha. Check out their charts, data, education, trading community, and more!