Option trading is all about finding cheap volatility to buy, and expensive volatility to sell

To make this easier for you, we have 5 pre built scanners in the Predicting Alpha terminal which allow you to quickly sort the market to find opportunities that most traders can’t find.

With each of these scanners, you are able to monetize a different risk premium. This is a great starting point for running +EV volatility strategies and turning your option trading into a business.

How to Find Profitable Trades

The Predicting Alpha Terminal is dedicated to one objective: finding profitable trades.

In order to do this, we need to first to do two things effectively:

- Generate lists of trades with high profit potential

- Analyze these trades to find which ones have the biggest edge (and then trade them!).

To accomplish step 1, professional traders, and now you, make use of high quality option scanners.

Use our scans, save your time.

When you sign into the terminal, the first page you see is our option scanner. Within this page you have access to evaluating thousands of tickers based on hundreds of criteria.

So to help you get started, we created a set of scans and watchlists that we use for our own trading to find profitable trades. Each one is designed to target a different trading opportunity and you have access to them so you can start finding trades today.

The pre built scanners allow you to do everything from analyze macro volatility changes, find expensive short dated options (0-10DTE), medium dated options (30-45DTE) and long dated options (60DTE +). You are able to find mispriced options around earnings events, and even find cheap calendar spreads to buy.

Pre-Built Strategy Scans – Breakdown:

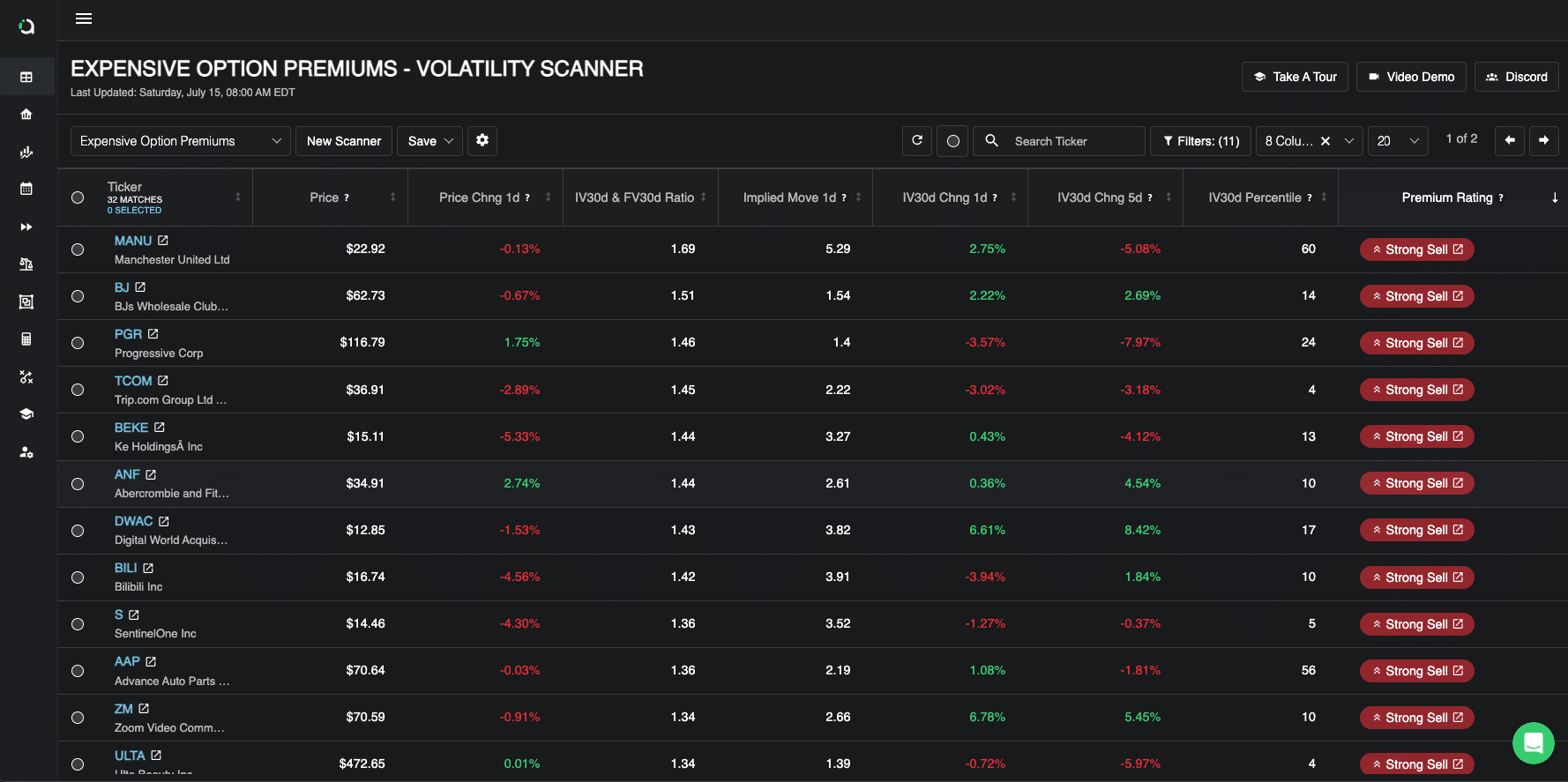

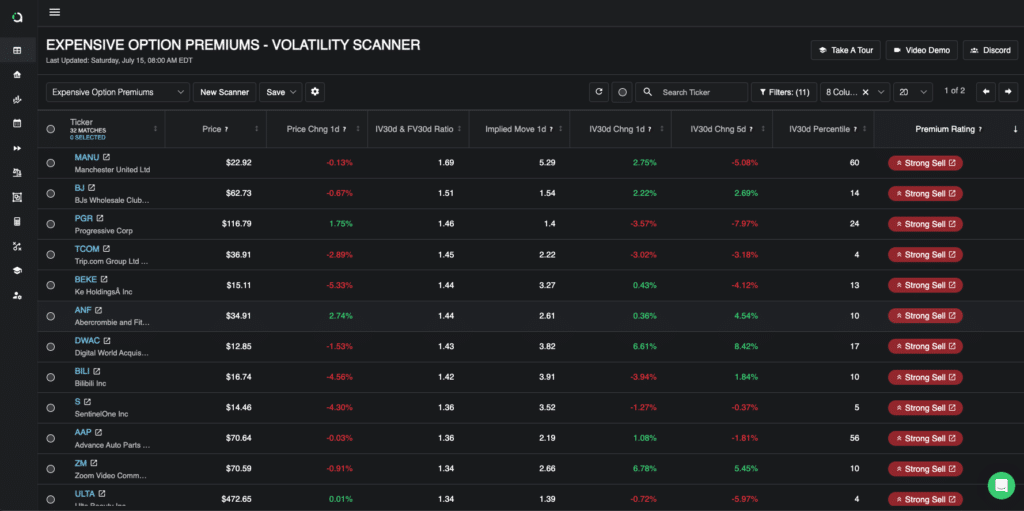

Expensive Option Premiums:

If you’re looking for option selling opportunities, this scanner is perfect for you. This is the default scanner you see when you open the Terminal. It helps you identify expensive options with a duration of roughly 30 days to expiration (DTE). This scanner is built using our forecast of volatility and comparing it to implied and realized volatilities for every ticker. By default the table shows you the most important data points, our Premium Rating, and the Premium Report which you access by clicking on the rating. By highlighting these pricey options, you can focus on potential high-return trades or explore strategies like shorting overpriced options.

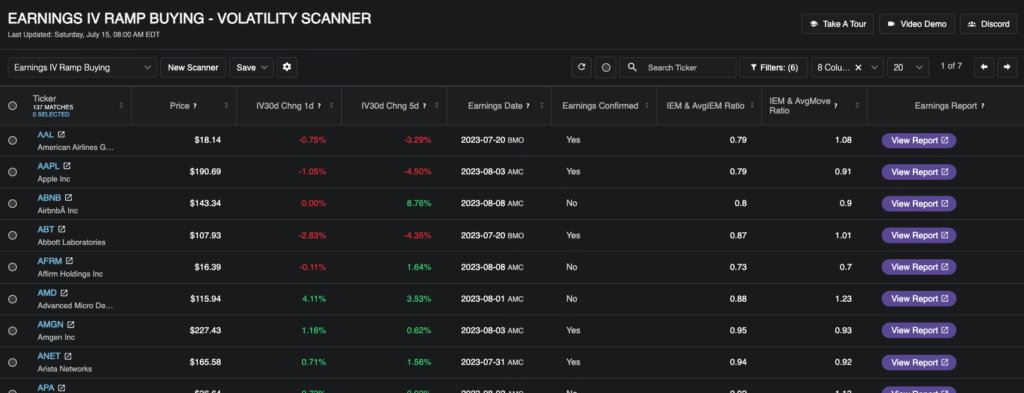

Earnings IV Ramp Strategy:

This scanner looks for tickers who have earnings events happening in the next 30 days and ranks them by the ones that current have the lowest implied earnings move relative to the average implied earnings move for that ticker. The idea is that the implied move will increase as the event approaches allowing you to profit from long volatility strategies.

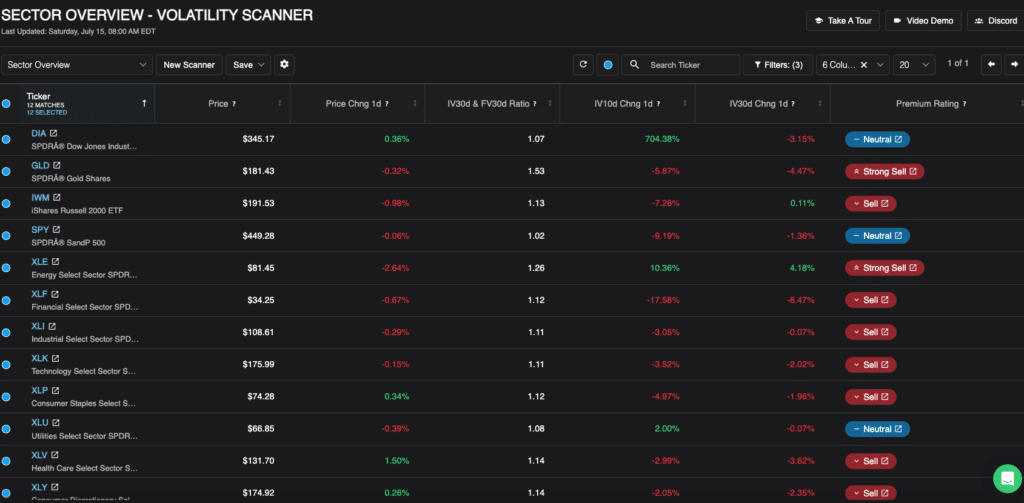

Sector Overview Scanner:

This scanner is designed to analyze macro volatility changes in the market. It allows you to track and identify shifts in overall market volatility, by showing you the IV changes, price changes, and IVvsFV ratios for different major ETFs. By monitoring these macro volatility changes, you can stay ahead of market trends and make informed trading decisions.

Earnings Strategy Scanner:

Earnings events often create volatility and present unique trading opportunities. This scanner enables you to find mispriced options specifically related to earnings events. By identifying these mispricings, you can potentially capitalize on market inefficiencies, such as taking advantage of elevated implied volatility or positioning yourself for post-earnings price movements.

Cheap Calendar Spreads Scanner:

Calendar spreads involve simultaneously buying and selling options with different expiration dates. This scanner helps you find cheap calendar spreads to buy, allowing you to profit from time decay and volatility changes between the two options. By leveraging this scanner, you can identify favorable calendar spread opportunities and implement this strategy in your trading.

Each of these pre-built scanners is designed to simplify your trading process and provide you with valuable insights. They offer a diverse range of scanning capabilities, empowering you to uncover profitable trades based on different market conditions, time horizons, and trading strategies.

Selecting Scanners

When you sign into the terminal, you will automatically see our Expensive Option Premiums Scanner.

In order to switch between scans, click the dropdown menu in the top left corner of the scanner dashboard. In this dropdown you will see an area for your custom made scans, and underneath that, an area for the pre-built scans! Simply click on the scan that you wish to use and it will automatically populate with the selected scan’s dashboard.

Clickable Metrics

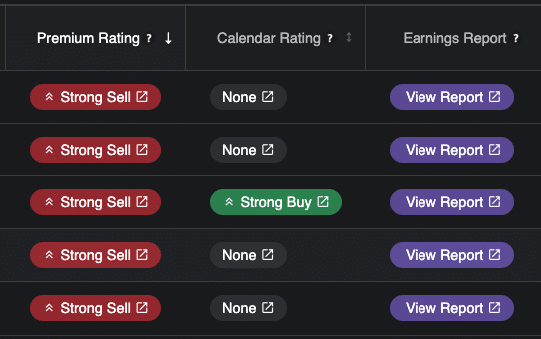

Looking at the columns on each scanners dashboard, you will notice that some of the are shaped like a button. As of the writing of this article, the “Premium Rating”, “Calendar Rating” and “Earnings Report” are three metrics like this.

These ones are unique (firstly because they help you identify good trades) but also because you can click on them!

For each of the ratings metrics, you can click on the rating given to the ticker you are looking at and a new window will pop up with the key information related to the alert. This functionality makes it easy for you to quickly assess trades without needing to leave the scanner.

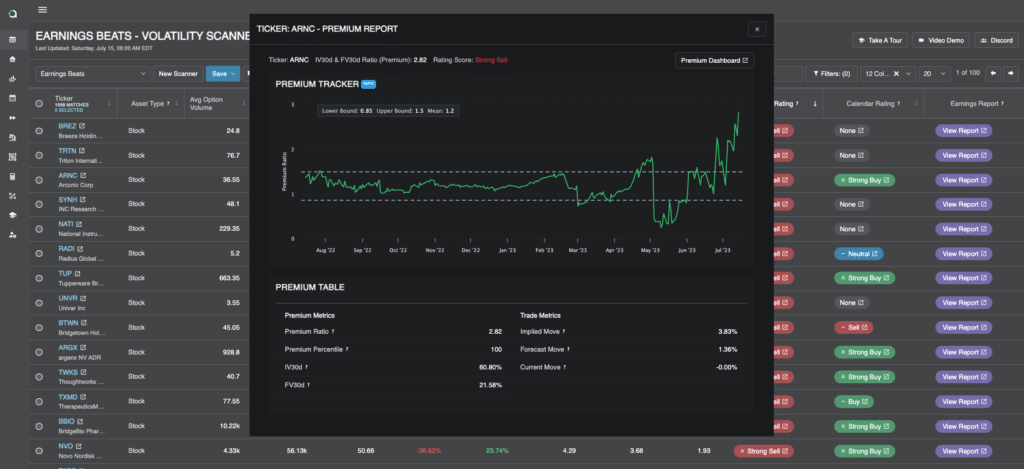

This picture shows you the report that appears when you click the premium rating for a ticker.

The report gives you the key information for evaluating if the option prices are cheap or expensive. The first thing it shows you is how the option premium has changed in value over the last year. This is calculated as the spread between the implied volatility for 30 day options and our statistical forecast of 30 day future volatility.

From there, you can see the key statistics for this ratio, and a quick comparison of the implied, forecasted and realized moves today. This allows you to see if you would be making or losing money if you were in a trade right now!

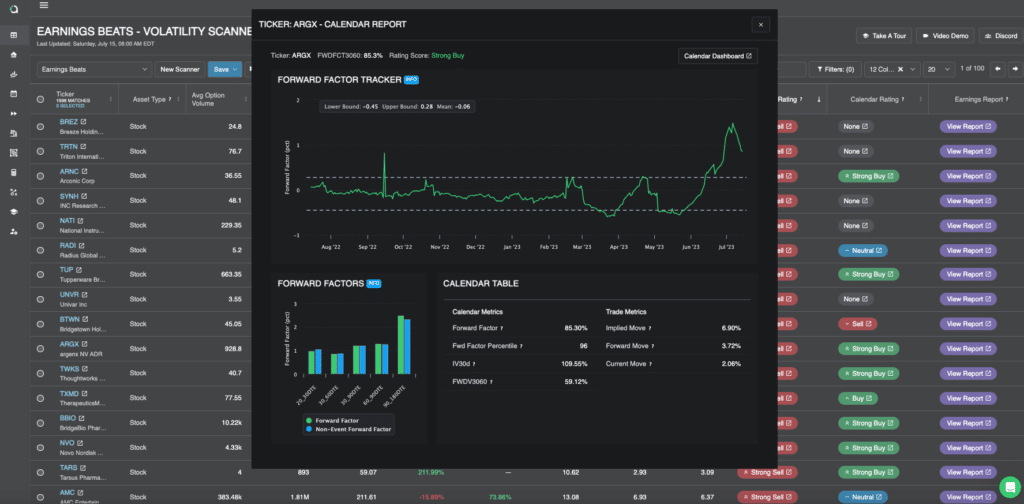

This picture shows you the report that appears when you click the Calendar Rating

This report gives you the key information for evaluating if you should buy or sell calendar spreads. The first thing it shows you is the forward factor tracker, which is how the signal used for buy/sell alerts has changed over the last year. We want to see it higher than the upper bound line if we are buying and lower than the lower bound line if we are selling. You will then have key metrics for different expirations, signal percentiles, and daily moves.

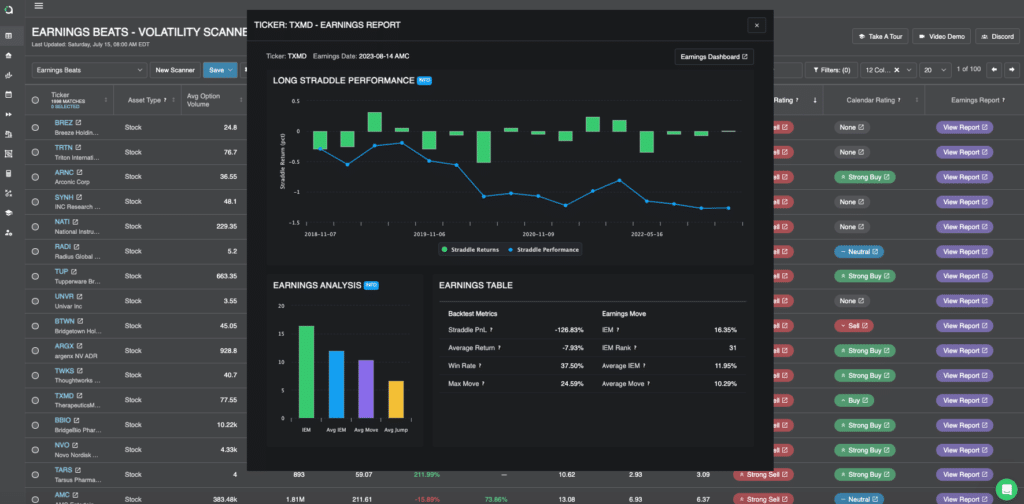

This picture shows you the report that appears when you click Earnings Report

This report gives you the key information for evaluating if you should buy or sell volatility around earnings events. The first thing it shows you is a strategy backtest for buying straddles around each earnings event over the last year. A positive PnL indicates that buying volatility has been profitable. A negative PnL indicates that selling volatility has been profitable.

From there, you are able to see the earnings analysis for the upcoming even which tells you the 4 key metrics you need to make a trade decision. Finally, you get a summary of the earnings report which gives the rest of the details needed to confirm the event date and whether you should be buying or selling volatility.

Conclusion

The pre-built scanners in the Predicting Alpha Terminal offer a wide range of scanning capabilities, empowering you to uncover profitable trades in various market conditions and time horizons. Whether you’re interested in analyzing macro volatility changes, identifying expensive or mispriced options, or exploring calendar spreads, these scanners provide valuable insights to enhance your trading strategies. Additionally, the terminal allows you to switch between different scanners and utilize clickable metrics for quick assessment. Moreover, you have the flexibility to customize and save your own scans. Start leveraging these pre-built scanners today and make the most of the Predicting Alpha Terminal’s powerful features to optimize your trading decisions.