The core business of almost every trading operation should be based on risk premia. Right now, GLD makes for a VRP trade that should earn 0.75% within ten days.

Overview of GLD

GLD is an ETF that tracks the price of physical gold. Its only holding is a vault with gold bars, probably somewhere safe and heavily guarded.

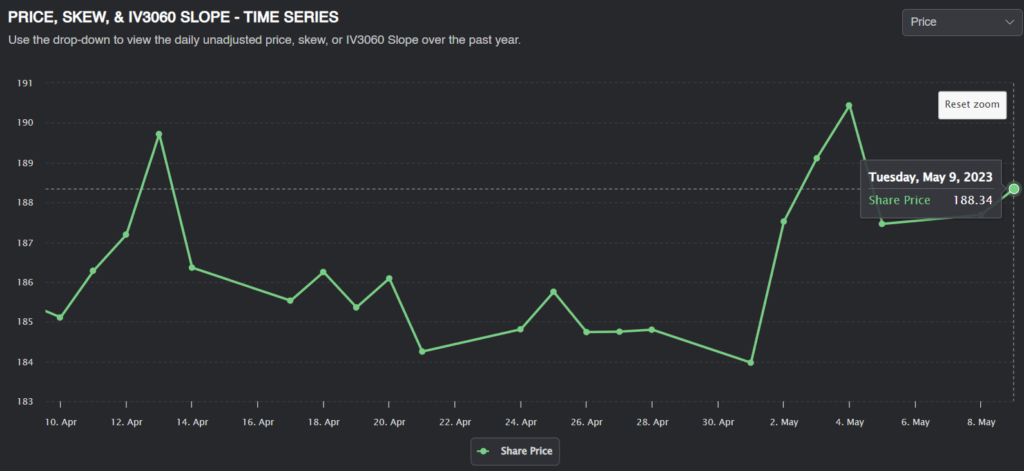

Here’s how the ETF has been moving this month:

It’s been trading sideways for quite a while, especially considering the options market’s expectation of GLD volatility. The options market has been implying a 1.09% daily move in GLD, but over the last 30 days, the ETF has moved around 0.8% daily. The ETF has also been range bound, moving only 1.7% this month.

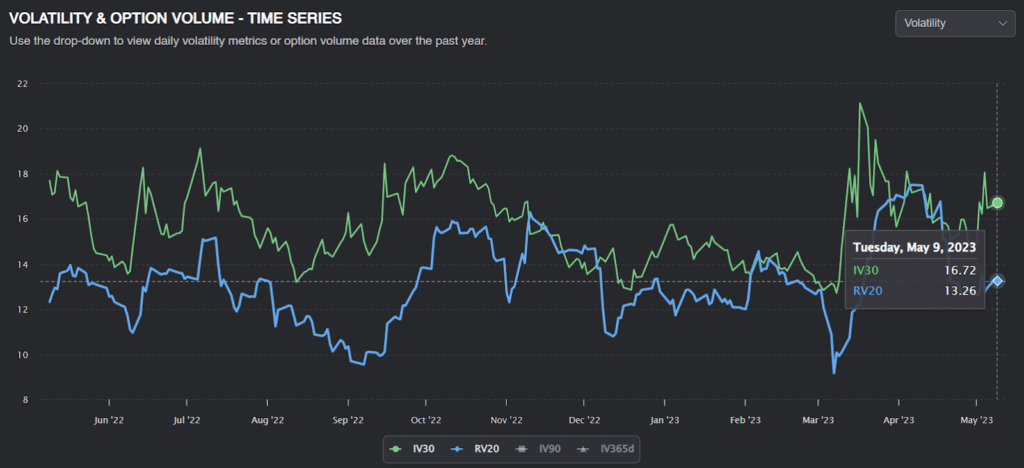

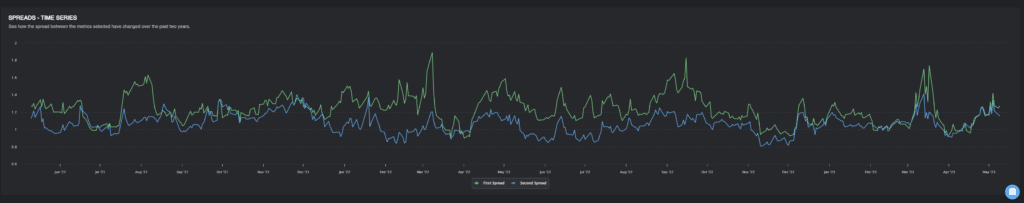

Looking at the implied volatility graph, we can see that there has been a fairly significant premium in GLD options for the better part of the year, so this is a great opportunity to sell options for some consistent income.

A quick look at the IV/RV ratio of GLD confirms a consistent risk premium for this ETF. IV is rarely less than realized volatility, save for several brief periods over the last several years.

Looking at historical data, it appears that GLD options are expensive. However, we can go one step further and compare GLD volatility to options of similar ETFs.

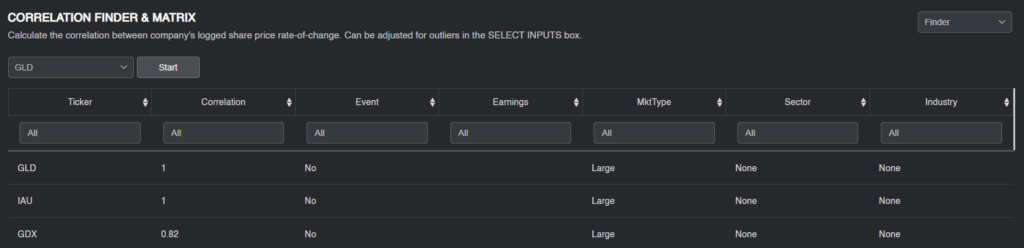

The first thing we can do is find correlated stocks.

GDX — a gold miner ETF — is quite correlated with GLD. This makes sense, considering that both are gold-related stocks.

We want to find correlated companies because if the price action for the stocks is similar, then the implied/realized vol ratios should be similar.

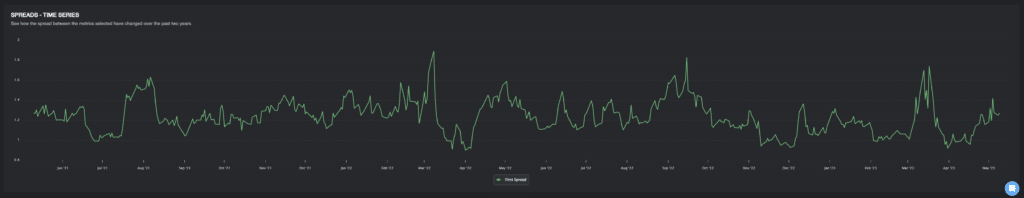

We can now compare the IV/RV ratios for the correlated stocks. It can help us benchmark the “fair value” of volatility for the ticker we are analyzing.

Interestingly, we can see that the IV/RV ratio for GLD (Green) is quite consistently above the IV/RV ratio for GDX (Blue). Even though GDX’s IV/RV ratio is already above 1, GLD’s IV/RV ratio is chronically higher for some reason, even compared to GDX.

This is starting to look like an overpriced risk premium.

Forecasting Volatility

We’ve established that GLD options are likely overpriced. As good traders, though, we want to price these options and quantify how large our edge is.

I will do this by taking a blend of 3 things:

- The PA forecast of volatility

- The historical average implied volatility for GLD

- The RV which would bring GLD’s IV/RV ratio in line with GDX’s

PA Forecast: 10.8%

Historical Average Implied Volatility: 17%

IV/RV Ratio Adjustment: 14.5%

The average of all three is 14.1%.

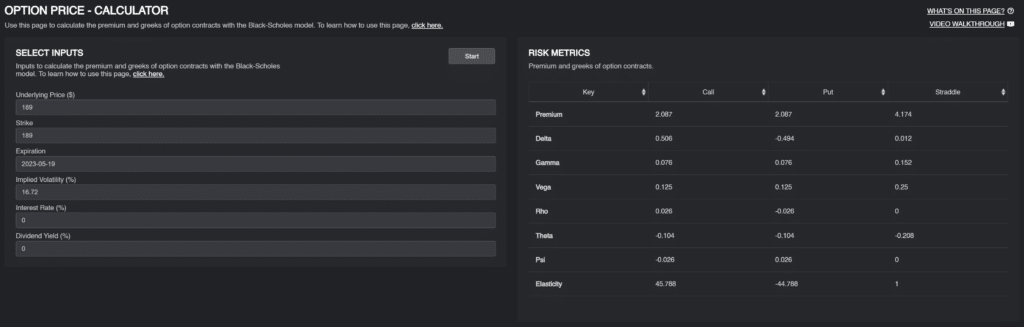

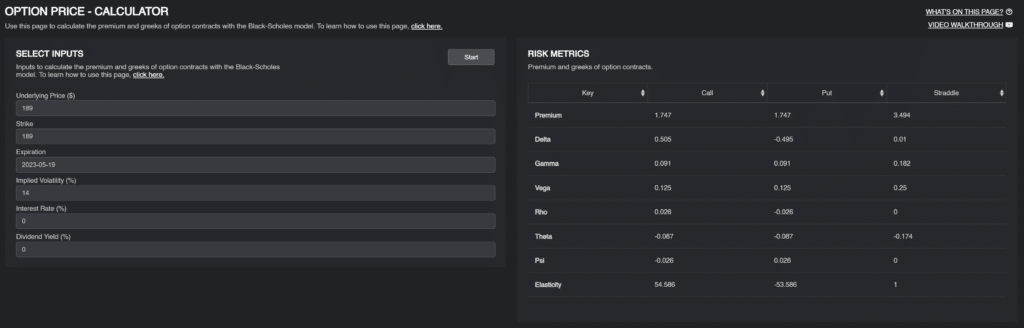

Given this forecast of volatility, here is the current price of the at-the-money straddle and the “fair value” given our volatility forecast.

Current price of the ATM May Straddle: $4.17

The price of the ATM May Straddle at 14% IV: $3.49

Since the straddle requires about $8,500 in margin, a ~$65 profit translates to a 0.75% return on margin over just ten days.

Position Sizing and Management.

For a trade like this, I am not looking to load the boat on it. This is just another part of a short volatility book, but with some good research to back it ( when you build a book of trades like this, you do pretty well). So I would be sizing this relatively small and stressing this position to a 1.5x straddle price move. I would use that as my max loss scenario, where I would certainly be looking to cut the trade.

I am comfortable using this because GLD is an ETF, so we don’t carry the same “blow-up risk” as single-name trades.

As for position management, I would continue to hold this trade if GLD realizes less volatility than implied. If we start to see multiple days in a row of outsized moves, I would cut the position early, even at a loss. Of course, if implied volatility drops, we can get out once the edge is gone.

Conclusion

I want to reiterate that this is just one of many trades that should be a part of a short-vol book. The research is solid, but the edge that it gives us is not enough for “Let’s yolo our life savings.”

So trade it small; find many similar trades to spread your risk!

Good luck, and happy trading.