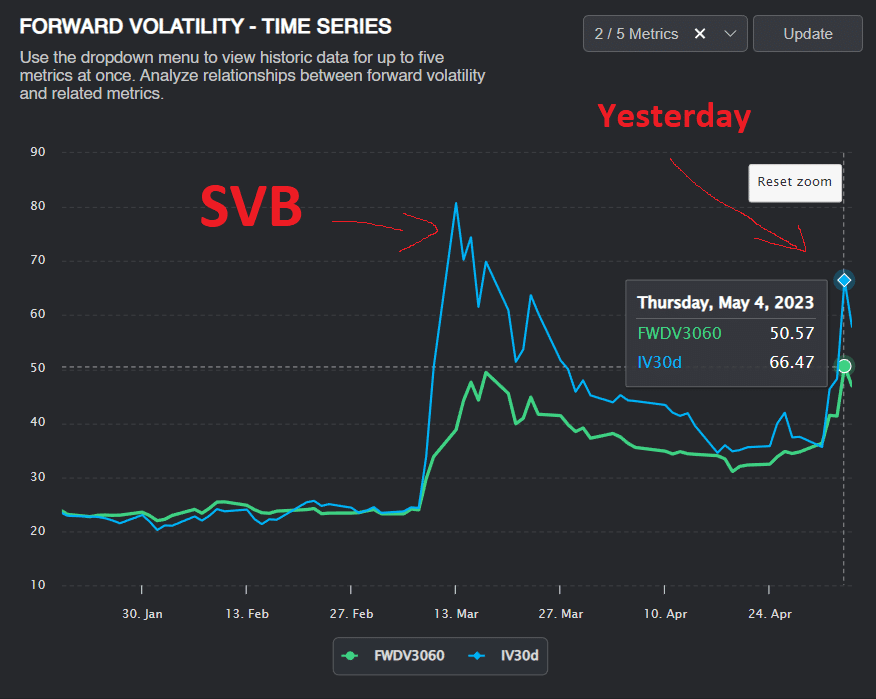

A while ago, I wrote about a calendar trade I put on when Silicon Valley Bank was collapsing.

Because of the market panic, weekly options were extremely expensive relative to monthly options. The market was pricing in huge moves in the short term but very little in the long term.

This week, the same trade opportunity presented itself.

First Republic Bank collapsed this week. Stocks like WAL are down as much as 33% this week, and the markets are spooked. Implied volatility for KRE —the S&P Regional Banking ETF — was sky-high.

My original article talks about Jim Campasano’s research in more detail, but here is a summarized version:

Jim Campasano, a former hedge fund manager, found that forward volatility is a poor predictor of future implied volatility. Market stress often causes overestimation of short-term volatility, resulting in low forward volatility. Calendar spreads can be profitable as long as the long-term option doesn’t experience too much IV Crush.

By buying a calendar spread, we’re selling expensive short-term options and hedging with the cheaper long-term ones. We could sell weekly straddles outright, but then we would blow up if the regional banking sector collapsed. A calendar is a debit trade with a defined risk.

The Numbers:

Generally speaking, a calendar’s profitability is proportional to how backwardated the options term structure is. You can measure backwardation in several different ways, but the paper uses a ratio of implied and forward volatility. I use a tool that helps me calculate this ratio as a “Forward Factor”.

As of yesterday’s close, May 19 $36 puts had an implied vol of 80%, and June 16 $36 puts had a vol of 64%.

Plugging the numbers into my calculator, I translated this to a Forward Factor of 49%. You can use different metrics and whatnot, but I generally consider trades with a Forward Factor of 20% to be worth taking.

Structuring the Trade

I bought several KRE May 19/June 16 $36 Put calendars, which I expect to show a significant profit by May 19. However, since calendar spreads have a lot of variance (they can go to 0), I only invested an amount I was willing to lose entirely. Considering I managed to buy calendars for $80 each, sizing appropriately is quite easy.

By selling a weekly option and buying a monthly option, I was betting that the relative prices of these two options were wrong. If regional banks crash, volatility would remain high (in which case the monthly option was underpriced). If the regional banks recover quickly with help from the Feds, vol would die down quickly (in which case the weekly option was way overpriced).

Because calendar spreads are debit positions, I probably won’t bother Delta hedging this trade. I may roll my calendar if the stock moves too far from the strike, but that’s about it.

Is anyone else looking at trades related to regional banks?

I’d love to hear from all of you who are making similar trades, and if you’re fading me, I’d love to know why 😛

If anyone wants to read about my original KRE trade in March, you can find it here.