Article Summary:

- A call option is a financial instrument that grants the holder the right to purchase 100 shares of a pre-determined stock at a specific strike price and expiration date. Put options give holders the right to sell shares of a particular stock at a pre-determined price within a set amount of time.

- Intrinsic value refers to the real monetary value of an option at the time of its expiration date. For call options, this is when the stock price is higher than the specified strike price, while for put options, it’s when the stock price is below the strike price.

- When trading options, it is important to understand how implied and realized volatility can impact the option’s price. Implied volatility is the market’s expectation of how much an asset’s price will fluctuate over a certain period, while realized volatility measures historical price movements. When implied volatility increases, option prices rise, and vice versa.

What Is A Call Option?

A call option is a financial instrument that gives the holder the right to purchase 100 shares of a specified stock at the expiration date and strike price chosen. If the stock price exceeds the strike price, you can buy it for less than the current market value. But, of course, it works in reverse as well: if the stock price goes down below your strike price, you will not have any value from your call option, and it expires worthless.

People who buy call options are not necessarily obligated to take ownership of the stock before expiration – they can choose to close their position and take whatever profit or loss they may have made on that particular contract. However, if they decide to exercise their option, they can take ownership of the stock at a discounted rate (the strike price).

Payoff diagram of a $50 Call. Call buyers profit when the stock is above the strike price at expiration, as they can exercise the call and buy the stock below market price. If the stock is below the strike price at expiration, the call is worthless, and the investor loses the premium.

On the other hand, those who sell or short-sell calls must provide 100 shares at their expiration date and strike prices chosen if the stock’s value is above that point. They, too, can close their positions early to realize any potential profits or losses before expiration; however, they cannot decide if their options are exercised early or not.

Other variables also play an essential role in determining how much value lies within an option contract – such as time decay or volatility – but these principles give a basic framework for understanding how calls work regarding direction and pricing dynamics. With this knowledge, people can use call options within their investment strategies to better manage their portfolios.

What is a Put Option?

Put options are a derivative that enables the holder to sell shares of a particular stock at a predetermined price for a limited time. They function in contrast to call options, which provide the right to purchase stock at a set price. Investors often regard put contracts as an insurance policy against their stock holdings since it allows them to “lock in” the sale value of these shares.

Put option holders require the stock price to fall below the strike rate for their contracts to be profitable; if the stock price rises instead, the value of the put option is correspondingly diminished. Several variables influence put options pricing beyond directional share price movements, including volatility and time decay.

The potential payoff from investing in put options depends on the movement of share prices; if they go down below the strike rate before expiration occurs, then the holder will receive profits equal to the difference between that and current market prices. If instead, prices remain above or near strike values at expiration, the put expires worthless, and the investor will lose their entire premium invested.

Put sellers must buy 100 shares if the put option is exercised. They can always repurchase their options before they expire to close their short position but can never determine whether their option is exercised.

ITM, OTM & ATM

In the world of options trading, the terms’ in-the-money (ITM),’ ‘out-of-the-money (OTM),’ and ‘at-the-money (ATM)’ are commonly used to distinguish the strike price of an option from the current price of its underlying asset.

When an option is in-the-money, investors can exercise them for a profit; ITM calls can be exercised to buy the stock below market price, and ITM puts can be exercised to sell stock above the current market value. On the other hand, out-of-the-money options only carry extrinsic value and will expire worthless unless the stock price moves. At-the-money options are options where the strike is close to the stock’s market value. ATM options are most susceptible to changes in an asset’s market conditions, as even a tiny fluctuation can push these options ITM or OTM.

For example, if one were to sell an at-the-money put option for $2.00 and the underlying asset increased in price by 10 points, that put would become increasingly out of the money and eventually expire worthless should the trade remain open until expiration. In this case, if one wanted to close out such a position before expiration, they could buy back the put option, albeit for less than their original investment.

Intrinsic & Extrinsic Value

Intrinsic value refers to the actual monetary value of an option at its expiration date. In call options, this occurs when the stock price is higher than the specified strike price. In put options, intrinsic value exists when the stock price is lower than the strike price.

On the other hand, extrinsic value is a measure of worth that considers factors such as implied volatility and time left until expiration. The more time left until expiration, the greater the extrinsic value associated with an option contract. Likewise, investors bid option prices upwards when there is speculation that a stock may experience a significant price surge (this speculation is known as implied volatility).

Any given option’s total premium consists of intrinsic and extrinsic values. To illustrate, if XYZ stocks were trading at $50 per share and a $48 call option was available, the option would always have at least $2 in intrinsic value (as you would earn $2 exercising the call, buying the shares at $48 and selling immediately on the open market at $50).

All options possess some level of extrinsic value since there is always a possibility these contracts could attain some form of intrinsic worth before expiration.

When to Buy or Sell?

When trading options, it is essential to understand the concepts of implied volatility and realized volatility. Implied volatility measures how much market participants expect an asset’s price to fluctuate over a certain period, while realized volatility considers an asset’s actual price movements. Generally speaking, when the market’s expectation of volatility increases, the price of options contracts increases. This is because investors buy options to capitalize on the anticipated price movements. Conversely, if implied volatility is low, option prices will decrease as fewer investors will pay for these options.

Volatility benefits options buyers as this increases the probability that their options are deep in the money by expiration. Because option buyers can only lose the premium paid, they prefer volatile stocks as their downside is limited. Still, they can significantly profit when the stock price swings in the correct direction.

On the other hand, option sellers would prefer as little stock volatility as possible; since their profits are limited to the premium paid, they do not make an additional profit if the stock price moves quickly in their favor. They are hurt, however, when the stock price moves violently against them.

It is worth noting that implied volatility is often higher for volatile stocks – the increased volatility is priced into these options! Successful options traders look for situations where they expect realized volatility to differ from implied volatility. They can either buy relatively cheap options and benefit from the stock’s volatility or sell expensive options, collecting an overpriced premium. Ultimately, a firm understanding of implied volatility and its relation to realized volatility is an important factor in the long-term profitability of an options trader.

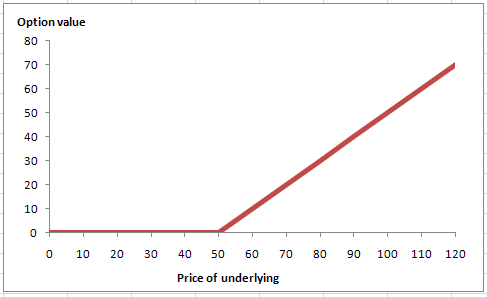

Implied Volatility and Realized Volatility for USO. This graph shows that options sellers tend to make money over time, as USO prices don’t fluctuate enough for option buyers to consistently make money.

Conclusion

Options trading is a complex and nuanced activity, with success depending on the trader’s knowledge of options and their understanding of implied volatility versus realized volatility. It is vital to remember option buyers should look for stocks with higher expected volatility, increasing the chances of these contracts being deeply in the money by the expiration date. Conversely, option sellers prefer low levels of stock movement since they can only make profits up to the amount they paid originally for these contracts. With all this in mind, traders must understand how different market conditions affect their trades before entering any long or short position!

Are you feeling stuck in your options trading? You aren’t alone. That’s why I’ve been teaching traders how to run data-driven strategies. If you are interested in my one on one coaching (which comes with access to data and a library of learning materials), then use this link to book a free call with me!