Everyone knows that after an earnings announcement, IV Crush demolishes the prices of options.

However, for EXPE and ETSY, prices after earnings were still too expensive.

To start, here’s how I found these trade opportunities:

Ran an expensive options scan. Looked for

- Price above $15

- Avg option volume above 3000 daily contracts

- Implied vs. realized 30-day vol ratio greater than 1.1

- No earnings event coming up in the next 30 days

Post Earnings Volatility

After earnings results are released, there’s no longer any uncertainty, so implied volatility should fall dramatically. At the same time, realized volatility should tick upward because stocks tend to move as the market reacts to the news.

In my daily scan though, I found that the IV/RV ratio looked quite high for EXPE and ETSY.

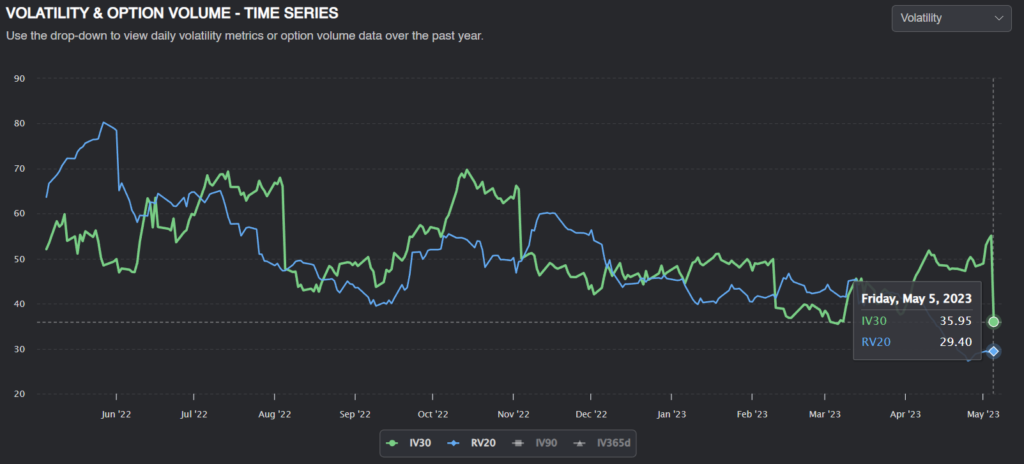

EXPE had an implied vol of nearly 36% Friday afternoon, even though realized volatility was under 30%! The options markets are implying that EXPE will see more volatility than the last 30 days, even though there are no earnings announcements for the next 3 months.

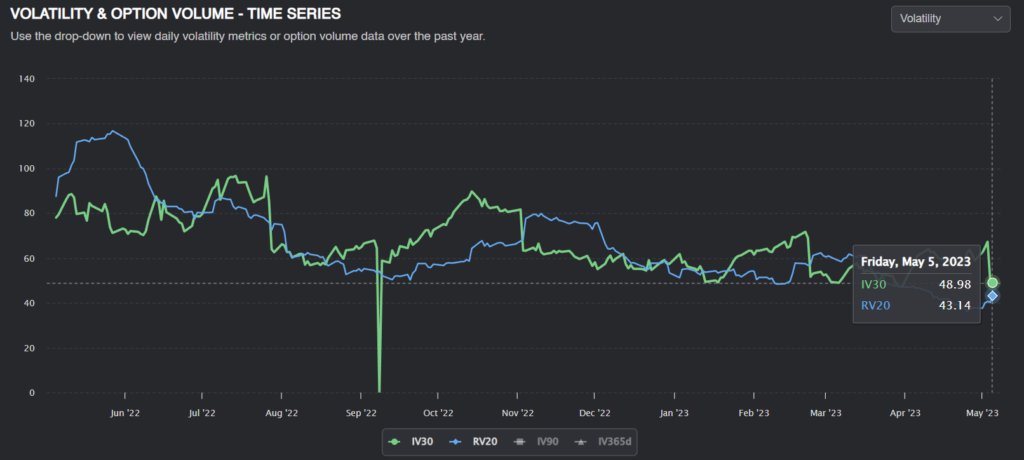

Similarly, ETSY implied volatility is more than 5 vol points higher than realized volatility.

Does Research Support Our Trade?

Recently, we interviewed Tim de Silva, a researcher from MIT who wrote about how retail options traders lose money around earnings announcements.

The paper has a few key points:

- Retail options traders tend to buy options before earnings, which is unprofitable.

- Retail traders prefer speculating on stocks with high expected earnings volatility. However, these options are the most overpriced.

- Retail traders fail to close their options positions after the announcement, and option prices continue to decay for several days afterward.

EXPE and ETSY had implied earnings moves of 9-10%, which is fairly high. For reference, AAPL has average implied earnings moves of 4% or so. They are also fairly well-known stocks, so we can be certain that there are a lot of retail traders speculating on them.

Structuring The Trade

ETSY

ETSY closed at around $89.9 on Friday. A May $90 Short Straddle requires about $4500 in margin and has 13.9 Vega. With a realized volatility of 43% even after the earnings jump, it’s reasonable to assume that implied volatility will fall to that level. Since IV is currently 49%, that’s an edge of up to 6 vol points.

With a 6-point edge, our expected profit would be about $80, a 1.78% return on margin over 14 days. Even conservative estimates look attractive; a 3-point edge and $6000 in margin (extra margin for delta hedging) still translates to a 0.67% return in two weeks.

EXPE

EXPE closed at around $93.5. a May 93/94 Short Straddle requires $4,400 in margin and has 14.4 Vega.

With an implied volatility of 36 and a realized volatility of 29, our potential profit of $100 is a 2.3% return on margin in 14 days. A conservative estimate of $50 profit and $6000 in margin nets us 0.8% in two weeks.

Conclusion

I want to clarify that this is just one of many trades that should be a part of a short-vol book. The research is solid, but it’s a small edge, not one where we want to “Yolo our life savings”.

Trade them small, find many trades, and reap those sweet, sweet premiums.