When it comes to finding and placing excellent trades there are three basic steps that you need to follow.

- Find that looks mispriced.

- Understand what is causing it to be mispriced.

- Structure a trade that capitalizes on the mispricing.

Up until now the Predicting Alpha Terminal has helped you execute step 1 and step 3 with precision. But our members have been forced to comb through dozens of articles in other places to find the why behind the inflated option premiums they see.

Not anymore!

See the most recent and relevant news for every ticker you search, built into your premium reports.

Whenever you generate an Option Premium Report, you will have access to the most recent articles from Zacks, Benzinga, Motley Fool, Marketwatch, and others.

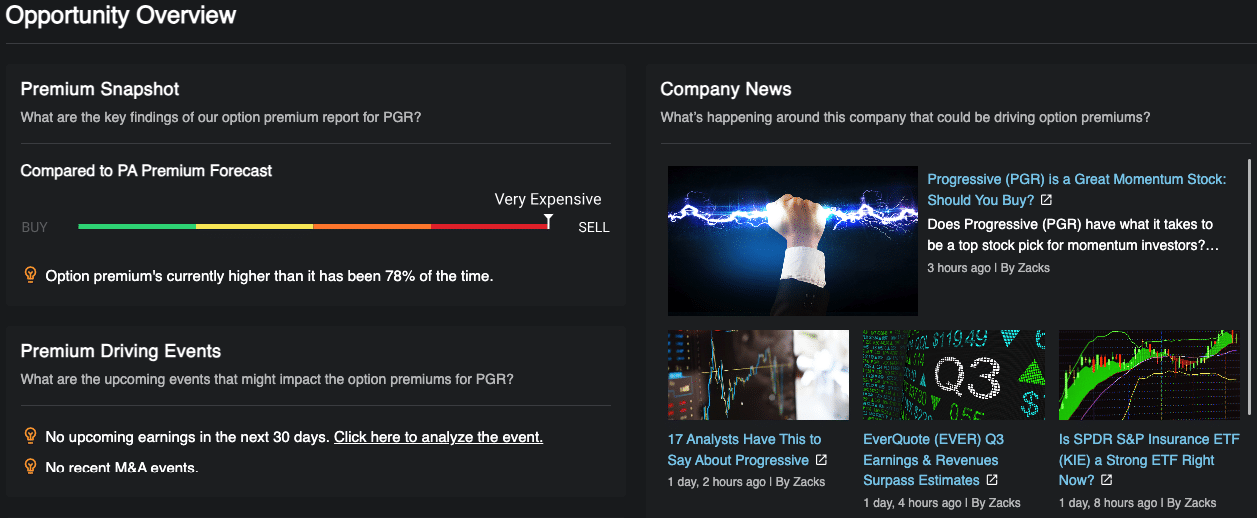

We specifically located the news right next to the Premium Snapshot, so that you can immediately see the relationship between the current option premiums and events happening around a company.

Here are some examples:

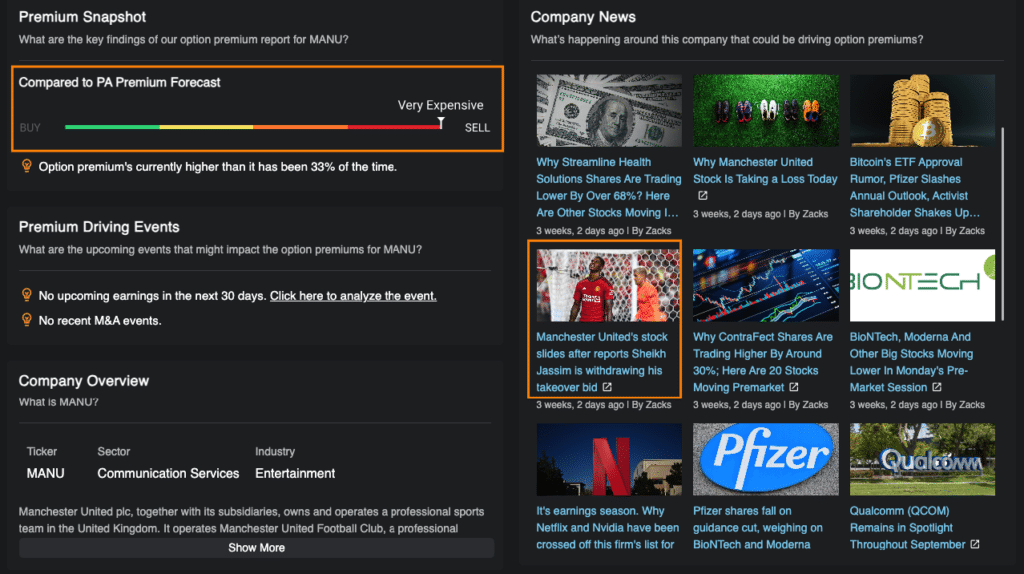

For Manchester United (Ticker: MANU), We are seeing “Very Expensive” Option Premiums, and looking at the news, we can see that fears about takeover offers being withdrawn could be responsible.

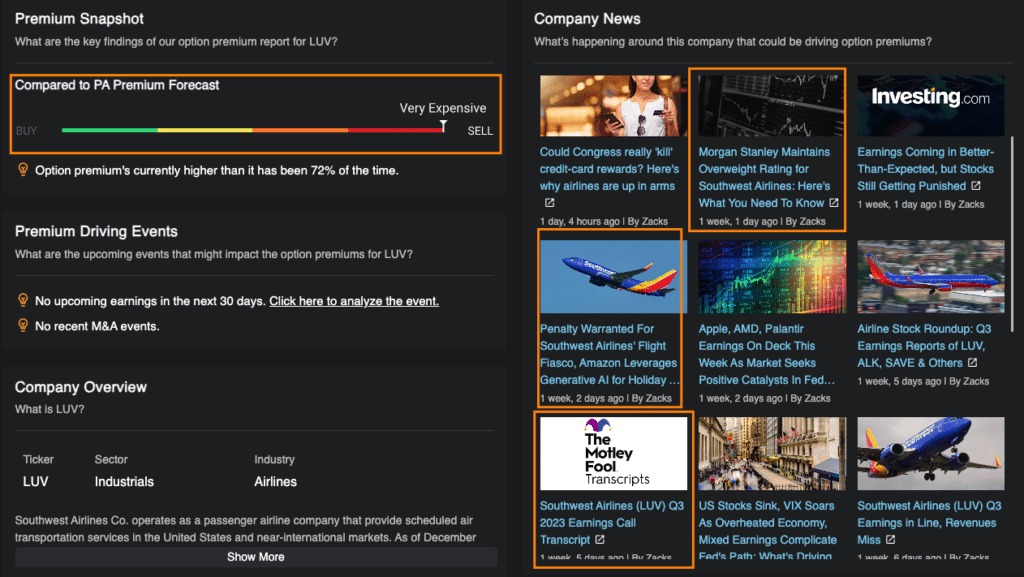

For Southwest Airlines (Ticker: LUV), which also has a “Very Expensive” Option Premium Rating a quick look shows us that recent earnings, Morgan Stanley Ratings and Penalties could be responsible.

In the same way we can quickly do these comparisons for MANU and LUV, we can do them for every ticker we want to analyze.

With the completion of this feature, you are now able to do a start to finish option premium analysis on one page, for every ticker.

You can find option selling opportunities, analyze them, and build data driven trading plans in an instant. Pretty cool stuff.

We’re looking forward to seeing the trades you find!

Happy Trading,

The Predicting Alpha Team