Article Summary:

- The Variance Risk Premium (VRP) is a concept that describes how implied volatility tends to be greater than the subsequent realized volatility, creating a valuable opportunity for those who are willing to accept the risk of selling volatility by writing options contracts.

- There are many reasons buying options is desirable, but writing options is risky. This creates a supply/demand imbalance that causes the Variance Risk Premium.

What is the Variance Risk Premium?

The variance risk premium (VRP) concept describes how implied volatility tends to be greater than the subsequent realized volatility. This phenomenon presents an excellent opportunity for those willing to accept the risk of selling volatility by writing options contracts and collecting premiums.

In the September/October 2015 issue of the Financial Analysts Journal, William Fallon, James Park, and Danny Yu conducted a study on the implications of global volatility premiums on asset allocation. Their research spanned 20 years from 1995 and analyzed returns to volatility exposure for 34 different asset markets. They found that shorting volatility offered a very high Sharpe ratio: 0.6 in equities, 0.5 in fixed income, 0.5 in currency, 1.5 in commodities, and 1.0 for a global VRP composite strategy (which is significantly higher than the 0.4 Sharpe ratio found with market beta premiums (stocks)).

The authors discovered that selling volatility was profitable nearly all the time – even during the five years around September 2008 – but warned that these strategies come with substantial tail risks. Even so, diversifying across multiple asset classes helped reduce tail risk while still providing significant performance benefits – improving Sharpe ratios by 31 percent overall.

Numerous academic studies have shown that the Volatility Risk Premium is persistent, pervasive, and resilient against varying maturities across assets (stocks, bonds, commodities, currencies) and worldwide regions. However, it’s also important to note that certain investments may be subject to factors independent of equity risks – for example, changes in gas prices due to weather or agricultural prices due to Midwestern floods like those experienced in May 2019. These occurrences can significantly affect the value of these assets regardless of their correlation with equity risks.

Reasons for Variance Premium

The variance premium exists due to various factors. Let’s go over some of them now.

Insurance

One of the primary motivations for investors to pay for options is that it helps protect against downside risks. By buying put options, investors can ensure they don’t suffer from any adverse price movements in the underlying asset. On the other hand, some investors buy call options as an insurance policy against missing out on rallies in an asset’s price.

Jump Risk

Other than insurance-driven reasons, another factor leading to the variance premium is jump risk; since prices often jump and aren’t continuous, this makes options more attractive than “dynamic hedging,” which cannot protect against such movements.

Selling is Restricted

Moreover, trading restrictions imposed on many retail traders often prevent them from selling naked options; this leaves them with no choice but to be long volatility and effectively bid up option prices even further.

Inventory Risk

Finally, one should consider inventory risk assumed by option market makers as another reason a variance premium is present. Market makers must hedge their risk when providing liquidity for customers, so they buy options – even though these may be overpriced relative to theoretical values. This way, they can benefit from trading opportunities in volatile markets where spreads widen and customer demand increases significantly.

In-depth study: The S&P 500 Volatility risk premium

Index put options are extremely attractive as they provide a way to hedge against market crashes effectively. This is especially true for markets with significant market capitalization, such as the S&P500, where many institutional investors engage in hedging activities. Because of institutional demand, the variance risk premium is reasonably consistent in the S&P 500.

The volatility risk premium associated with put options comes from the fact that those who buy them receive insurance against any potential losses due to declining equity markets. Of course, they must pay premiums for the protection provided by this insurance policy. Still, this amount is small compared to their potential losses from a sharp drop in stock prices. Buyers create an asymmetric payoff for themselves by purchasing puts, allowing them to reduce potential losses should stocks take a dramatic turn. Because of this method of risk transfer, sellers can expect a positive return on their investment through a corresponding risk premium.

The magnitude of the S&P Variance Risk Premium

The demand for index puts is evident in the implied volatilities of S&P500 puts. Historically, options implied a 13% chance of a 10% drawdown in the index, but the actual probability was 4%. We can see that buyers were willing to pay significantly higher prices for added protection against severe drops in stock prices. As a result, those who sell these puts can capture an attractive risk premium.

To illustrate further, let’s consider an example where we calculate how much a put option buyer may be willing to pay. For example, 2-month, 10% out-the-money S&P 500 options cost USD 14.3 on average. In contrast, the same option would only cost USD 4.1 on average if we calculated option prices using realized volatility. Buyers are more than happy to pay 3x times more than what could be considered fair value pricing to insure themselves against risks associated with sharp equity decline.

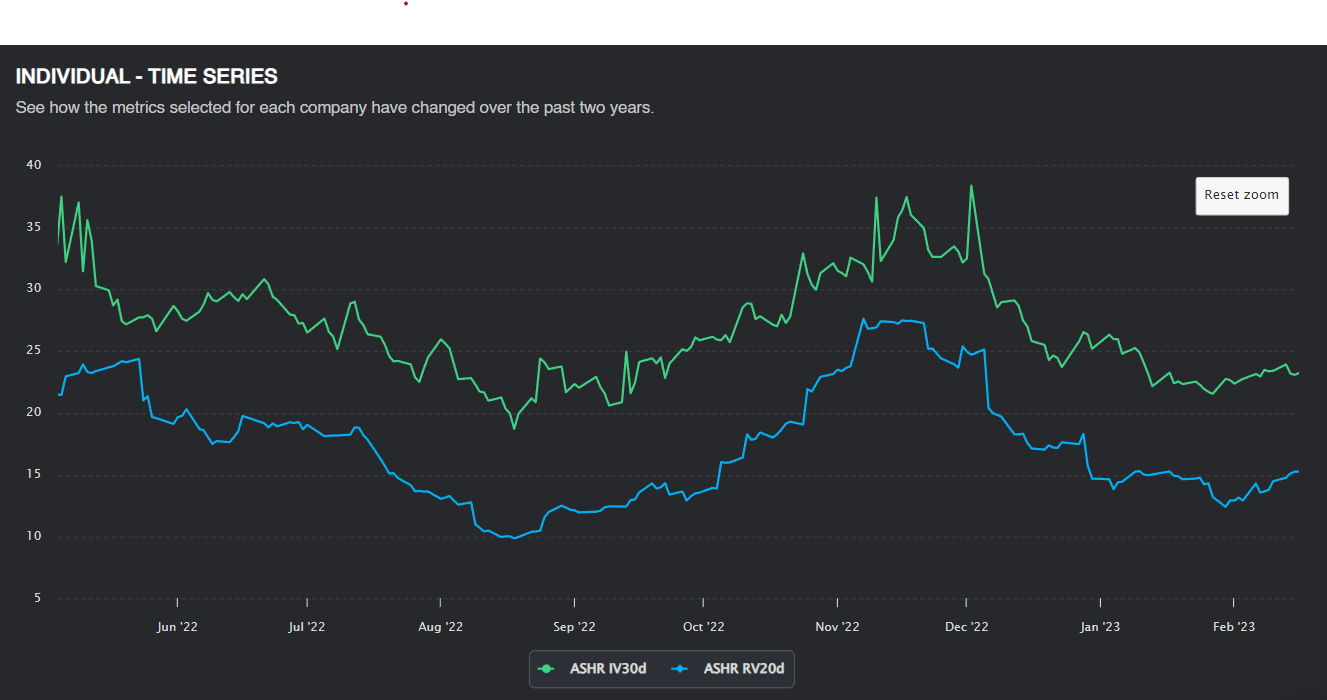

The S&P500 Variance Risk Premia is fairly significant; IV is, on average, 9% higher than RV.

Excellent Liquidity in S&P Options

The S&P500 put option market is also one of the world’s largest and most heavily traded options markets, with daily trading volume consistently reaching an average of nearly 94.4 million contracts in 2015. To put this figure into perspective, the average daily trading volume for EuroStoxx50 options during the same period was only 11.8 million – providing clear evidence of the sheer size and magnitude of the S&P500 market. Furthermore, since all transactions are handled through the Options Clearing Corporation (OCC) and take place on the CBOE exchange, investors can be assured that there is virtually no risk associated with being a counterparty in these trades. Additionally, due to its immense popularity and liquidity among traders around the globe, it is practically guaranteed that one will always be able to find someone willing to buy or sell S&P500 options at any given time.

SPY options are some of the most liquid in the world; put and call daily volumes are very rarely below 2M each.

The Consistency of the Variance Risk Premium

The difference between the implied and realized volatility for S&P500 put options with a two-month average time to expiration has historically been consistently positive. However, option sellers should not overlook that sharp drops have periodically broken this relationship in stock market prices and sudden surges in volatility.

The stability of the volatility risk premium is particularly noteworthy when one considers that since 2008, its magnitude has grown with the closure or significant downsizing of proprietary trading desks belonging to major investment banks. This indicates that investors can now generate more attractive returns by taking advantage of this premium through strategies such as shorting out-of-the-money S&P 500 puts until they reach maturity. This system can lead to considerable long-term profits.

Nevertheless, traders must acknowledge that significant declines in stock prices can have an acute impact on such strategies – something evidenced by the results of 2008 and 2011 – and investors who wish to minimize their level of risk may need to adjust or diversify their approach accordingly. This could involve hedging against specific potential losses using other products or increasing exposure to asset classes beyond equities; whatever solution is chosen must ensure a balanced portfolio that is prepared for any eventuality.

The S&P 500 Variance Risk Premium is persistent; IV is rarely less than RV.

Options Strategies for Harvesting The Variance Risk Premium

Short straddles, iron condors, short puts, and credit spreads are popular options strategies used by traders to harvest the volatility risk premium.

Delta- Neutral Options Strategies

The Short Straddle

A short straddle is a type of options trading strategy which involves simultaneously selling a put option and a call option on the same underlying asset with the same strike price and expiration date. This form of trading is popular among options traders as it allows them to benefit from a sideways-moving market without making any directional bets on the market direction.

When entering a short straddle position, the trader will collect premiums on both calls and put option contracts that they have sold. Assuming that there is no change in the price of the underlying asset, then these premiums will form the basis of their profit upon the expiration of these two options contracts.

The short straddle is excellent for collecting the variance risk premium because it has no directional bias when the trade is placed but is only short gamma, short vega, and long theta. The short straddle profits only from selling overpriced implied volatility; because the underlying asset fluctuates less than implied volatility would suggest, premiums overcompensate the options seller for bearing gamma risk.

The payoff diagram of a short straddle. Straddle sellers capitalize on time decay but are hurt by stock volatility. The short straddle profits if the stock price remains steady while sellers collect the premium over time.

The Iron Condor

The iron condor is an options trading strategy that combines two different types of spreads. It involves selling a straddle or strangle but then buying a further out-the-money strangle as insurance. The Iron Condor is similar to selling a straddle as it is short gamma, short vega, and long theta. However, the “wings” (long options) insure the trader against unexpected significant moves. The iron condor is one of the safer strategies for options trading because it is a “defined” risk trade. However, the trade-off is that traders must spend a portion of their profits on insurance themselves.

Payoff diagram of the Iron Condor

Directional Options Strategies

Short Put

A short put is an options trading strategy whereby investors sell out-of-the-money put options with the expectation that they will expire worthless. Investors can keep all premiums collected when they sell these puts if they do. This strategy benefits traders who want to collect the variance risk premium and are also bullish on the underlying asset.

The short put is an excellent strategy due to the variance risk premium; these puts expire out the money far more often than the market-implied volatility would suggest. The lower realized volatility also means that the average losses (when the put options are assigned) are less than the market would expect.

In addition to short gamma, short vega, and long theta, a short put is long delta. This means that the short put benefits from the fact that equities tend to increase in price over time. In addition, the short put’s directional bias creates another opportunity to profit even when the variance premium is smaller.

Payoff diagram of a short put. Put sellers will receive their maximum profit if the stock remains above the strike price at expiry. As such, put sellers hope there to be little to no volatility so that the stock price cannot fall below their strike.

Credit Spreads

In contrast to the short put, a credit spread is an options trading strategy that involves selling an out-the-money option and buying a further out-the-money option as insurance. This form of trading allows traders to reduce their risk. as long as both options are out-the-money, these credit spreads are short gamma, short vega, and long theta. Depending on whether a put or call credit spread is traded, Delta could either be positive or negative.

Like the Iron Condor, traders pay for insurance, so the trade-off for “defining” the trade’s risk is a portion of the potential profits.

This put credit spread is similar to the short put, except a further out-the-money put has been purchased as insurance against market crashes.

Conclusion

Harvesting the variance risk premium should be a large part of any good options trader’s repertoire. Understanding how to harvest this risk premium could be a valuable tool for any serious or experienced trader; analyzing the underlying asset and its implied volatility and selecting the right trading strategy can help traders capitalize on this risk premium. Additionally, understanding how these strategies are related in terms of the Greeks will be beneficial in creating more effective option trading strategies in the future.

It is important to note that option trading strategies involve risk and can result in losses. Therefore, it is advised to always trade with capital you are willing to lose and seek professional advice when necessary. Additionally, traders should comprehensively understand the risks associated with each strategy before engaging in any trades. Additionally, strategies should be monitored, adapted, and adjusted according to market conditions. This is important to ensure that the strategy remains effective and profitable. By properly assessing risk, trading strategies, analyzing market conditions, and having a solid understanding of options strategies and the Greeks, traders can be confident that they will have an edge in the markets.