One of the big reasons traders use Predicting Alpha is to find data-driven trades (shocker, I know).

Today we made that easier by launching 9 new strategy trade scanners that you can use today.

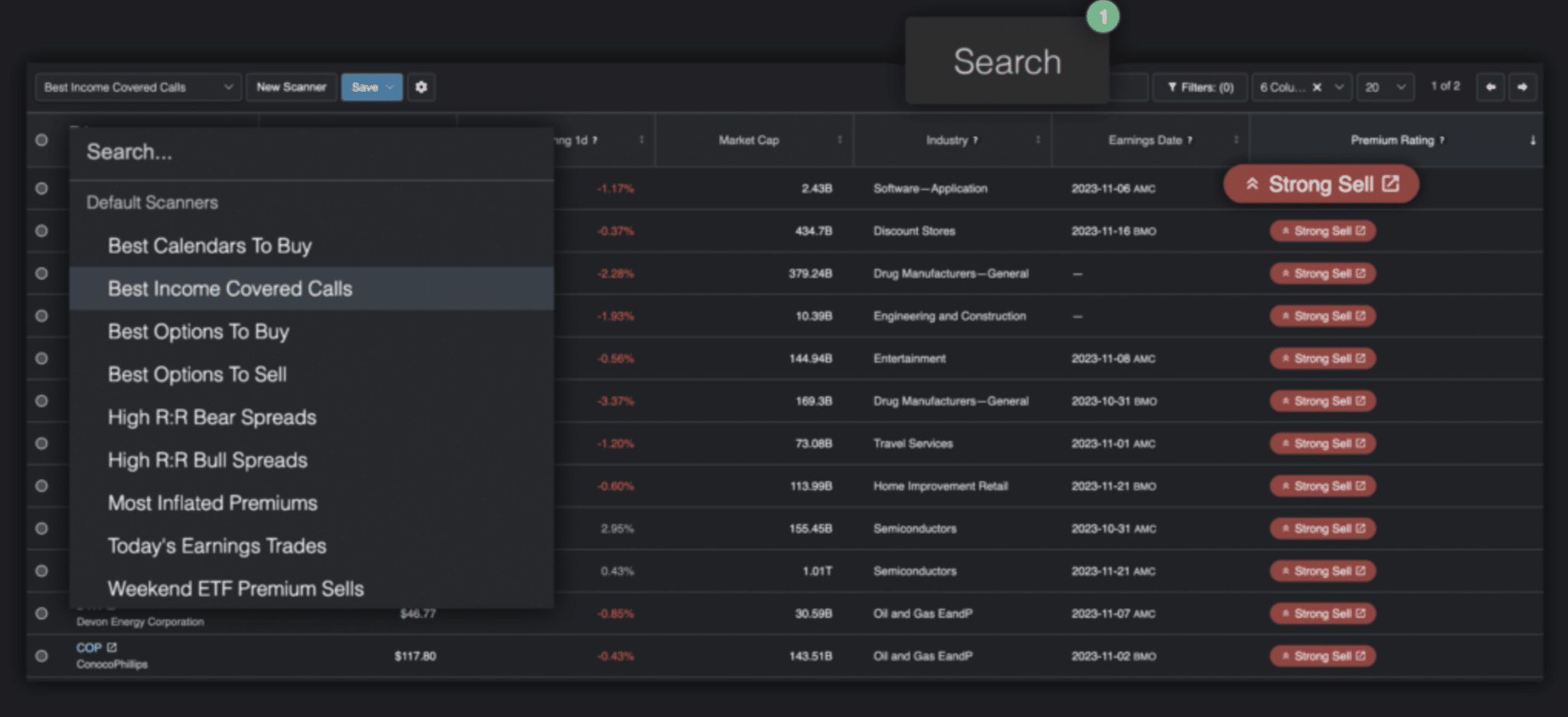

How to Access The Scanners:

All of these strategies are pre-loaded for you on the scanner page. All you need to do is click on the dropdown in the top left corner (see picture above) and a list of strategies will be made available. Click the strategy you want to find trades for and the scanner will automatically show you the search results.

The rest of this article goes over each strategy in depth.

It will cover how each strategy monetizes option premium mispricings, the factors that go into generating the trades, and how to know if it’s the right strategy for you.

Note: You can use the table of contents to skip to the strategy you are interested in!

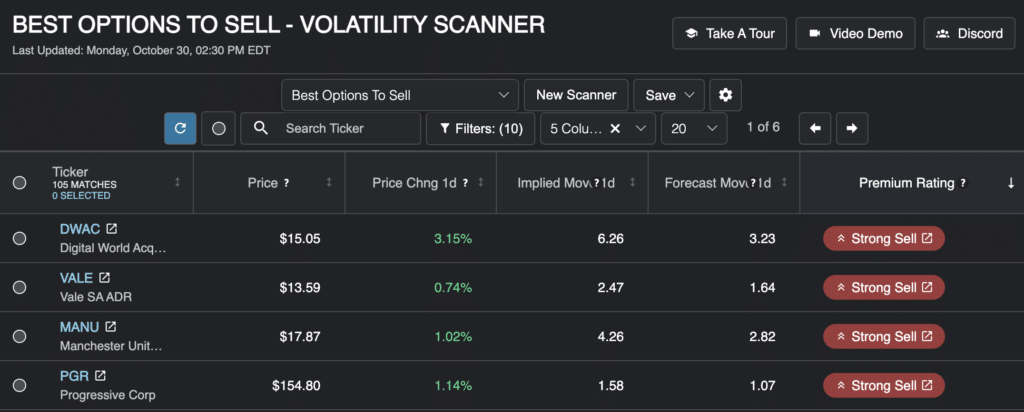

Best Options To Sell

What We Are Doing:

Selling options with overpriced premiums because we the stock will on average move less than what the market does over.

Why It Makes Money:

Options have a premium baked into them. This means that when you sell options, you are providing liquidity to the market and protection to the person on the other side of your trade. For this service and for taking on risk, you are compensated. The average return for selling options is 11% a year, this is the typical risk premium you are able to collect. What this strategy aims to do is capture premium that is overpriced, so that we can generate more than the typical return. We do this by using data to price the options and see where the market is willing to overpay. Then we try to understand why they are willing to overpay, and if we think they are being irrational, we can take the trade and make money if we are correct.

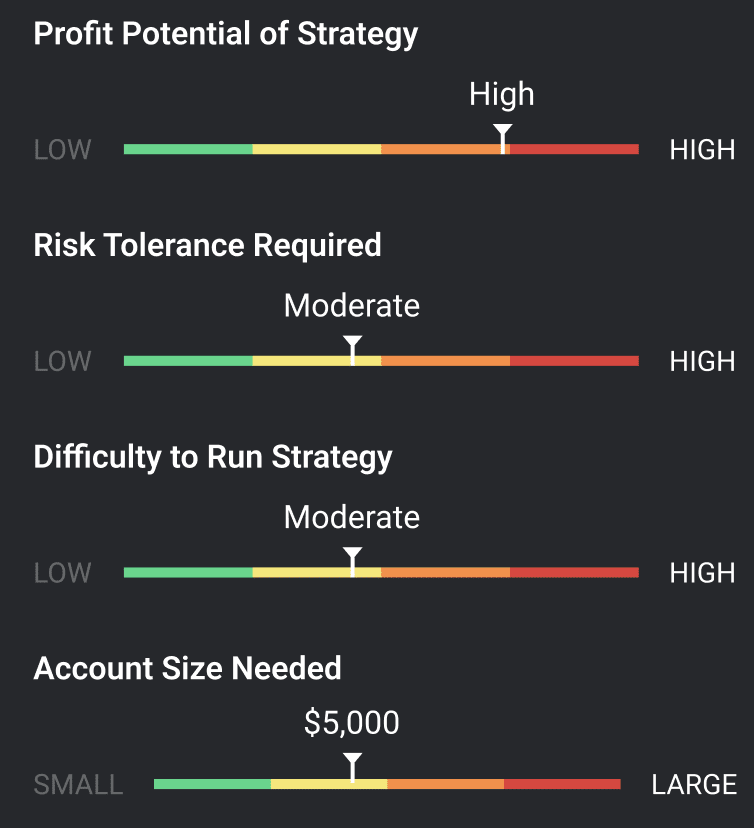

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Short straddle

- Short iron condor

- Bull Put Spreads

- Short Puts

- Cash Secured Puts

Trade Management Tips:

Close out if : 1) We reach our expected profit 2) We reach our stop loss (straddles, etc) or underlying price reaches the wings (for iron flys/condors). 3) We are approaching expiration. Remember, you are betting on the stock moving less than the market implies. If you are seeing it move less than the daily implied move, you are in good shape. Can smoothen PnL and optimize the trade by hedging deltas. For more information on hedging deltas, take a look in the education section.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

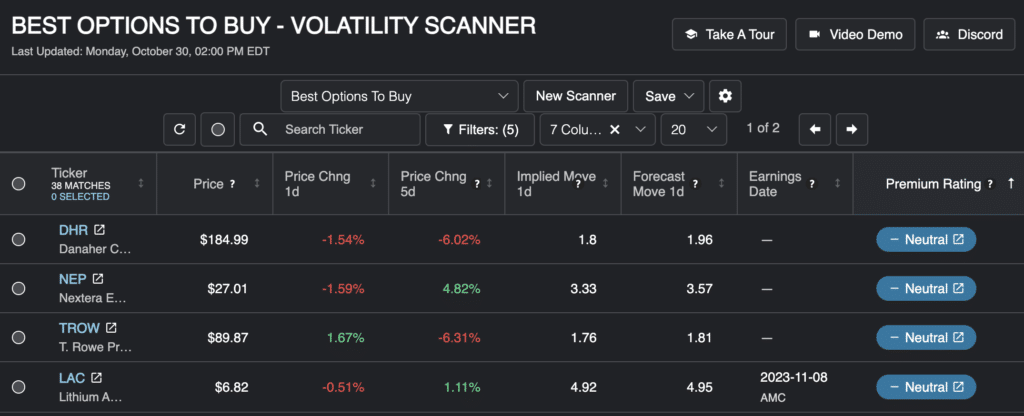

Best Options To Buy

What We Are Doing:

Buying underpriced options on stocks that have the potential to have big moves. By using data to isolate opportunities where options seem cheap, we give ourself the best chance of profiting from move in the underlying stock.

Why It Makes Money:

Options a premium baked into them. Typically when we buy options, we are overpaying for the exposure to a big move, leading to a loss over time. Think of it as buying insurance or lottery tickets: the premiums you pay will often outweigh the payouts when something big happens. Wha we are doing with this strategy is finding trades where the people selling options are undercharging for the potential of a big move. Then we want to buy it from them and now our winners will outweigh our losers. The nature of this strategy is that we will still have many small losers, but we will have a higher frequency of big winners than the average trader would, leading to outsized returns (or great option premium selling hedges) over time.

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Long Straddle

- Long Call

- Long Put

Trade Management Tips:

Most traders running this strategy look to exit for a profit at 100-200% returns, and close for a loss at 50% loss of the option premiums they paid.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

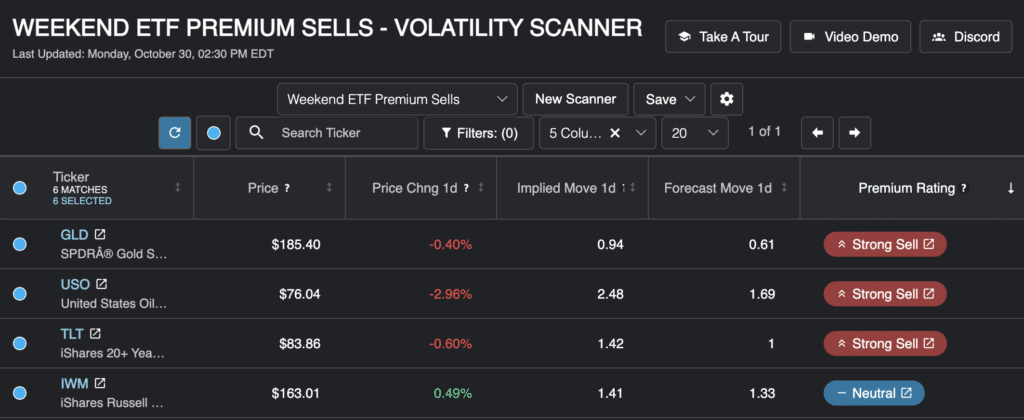

Weekend ETF Premium Sells

What We Are Doing:

Providing overpriced portfolio insurance to hedge funds in order to generate income over the weekend.

Why It Makes Money:

The primary reason this makes money is because there is no liquidity over the weekend, so you are able to collect a premium by selling “weekend insurance”.

The reason we do this on the big indexes is because most of the world is long equity/stocks. And when you are long equity, you want to hedge the risk of a crash, so most of these players go to indexes and buy puts.

This massive influx of demand means that demand outweighs supply, driving price up. We can generate income by selling these overpriced options, providing insurance to these people and collecting our premium. We will have to pay out sometimes, but because we are overcharging for our service, we make much more than we lose.

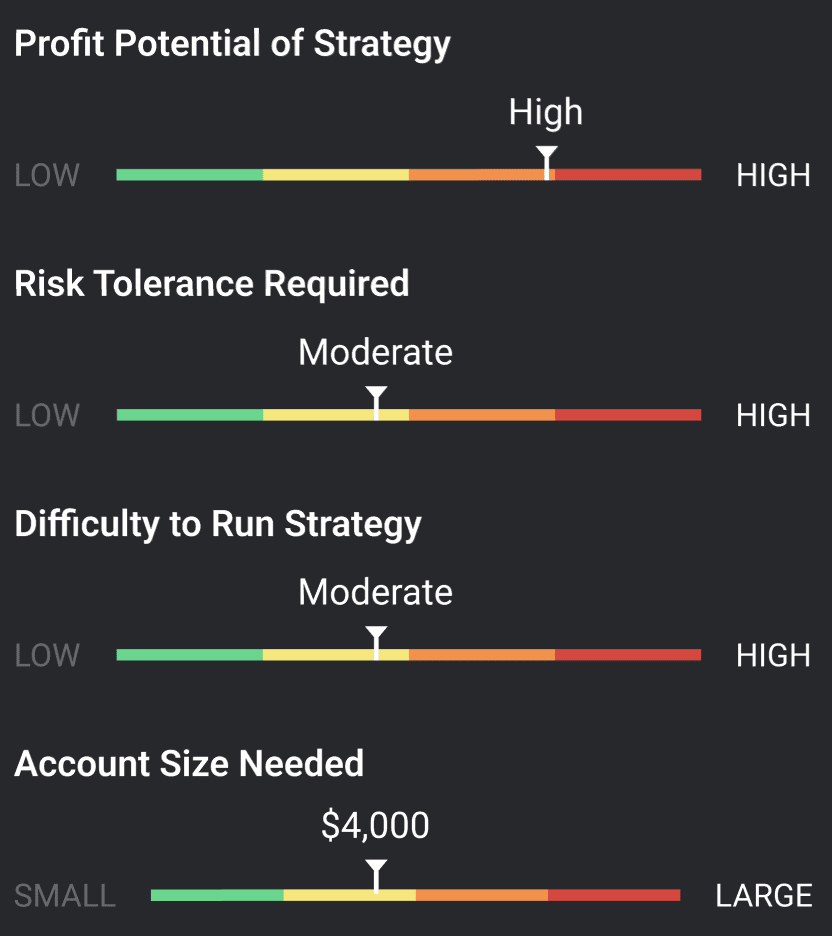

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Short straddle

- Short iron condor

- Bull Put Spreads

- Short Puts

- Cash Secured Puts

Trade Management Tips

Managing this position is straight forward. No delta hedging required or anything. On Fridays, just before market close, you sell options on the top tickers from this scanner. You sell the following Monday expiration. Close out the trades Monday after the open.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

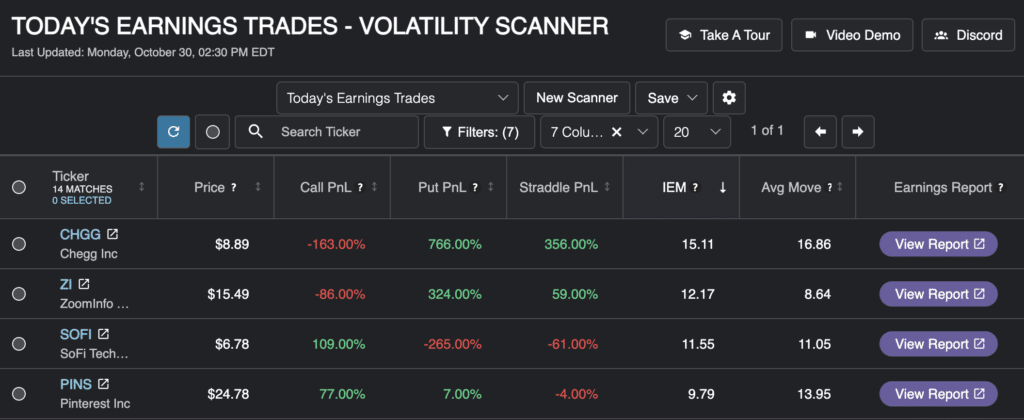

Today’s Earnings Trades

What We Are Doing:

Identify mispriced earnings moves. Buy cheap, sell expensive.

Why It Makes Money:

Earnings events make up 30-70% of the movement a stock experiences. Option premiums price this in so when there is an earnings event happening option premiums tend to be overpriced since the makret is not good at pricing options around earnings. This strategy looks at a number of different factors that help us determine if the market is being rational about how much the stock will move around earnings. This strategy is high variance which means there are not many option sellers. On the other hand, there are many people looking to buy options around earnings. This drives a very high profit factor for those who can run this option selling strategy effectively by using data to only take the high probability trades.

By looking at things such as the implied move vs average historical move, backtests of option premium profitability, the seasonality of earnings moves and more, we are able to determine if we should buy or selll options around earnings and make fantastic returns doing so.

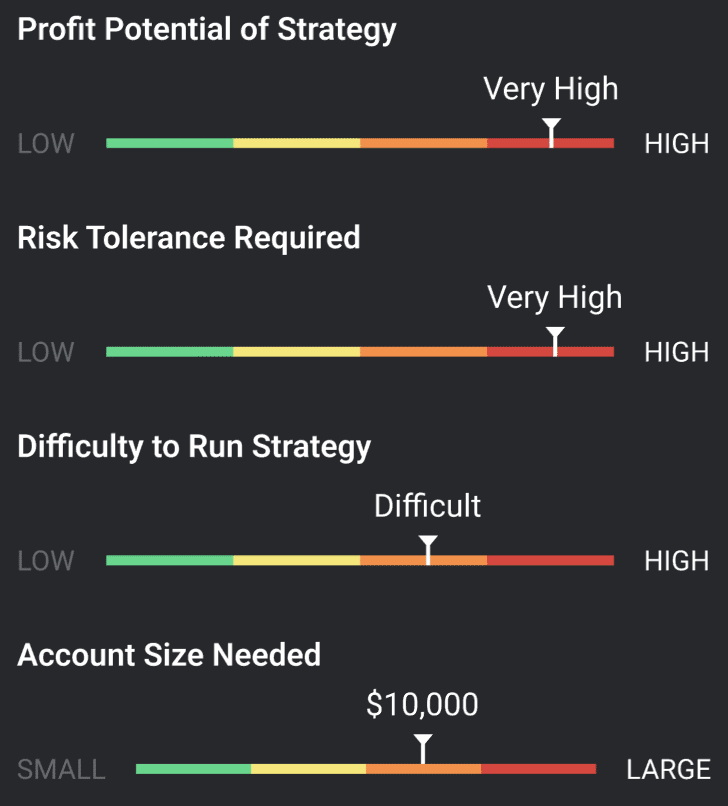

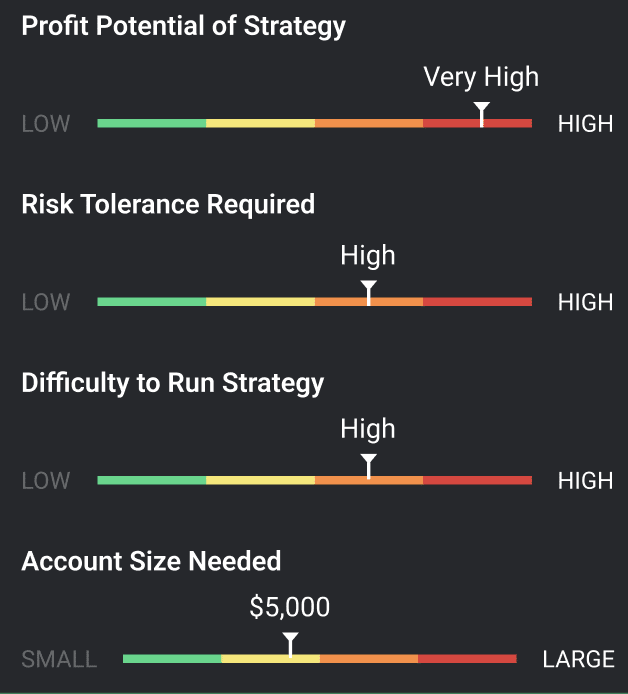

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Short straddle

- Short strangle

- Short iron condor

Trade Management Tips:

With this strategy we are looking to isolate the event volatility. To do this, we look to enter positions just before the close of the day before earnings information is released. We are then looking to close the position early the next day. We close the position once the event volatility is no longer priced into the options, or if there is a massive move beyond our break evens.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

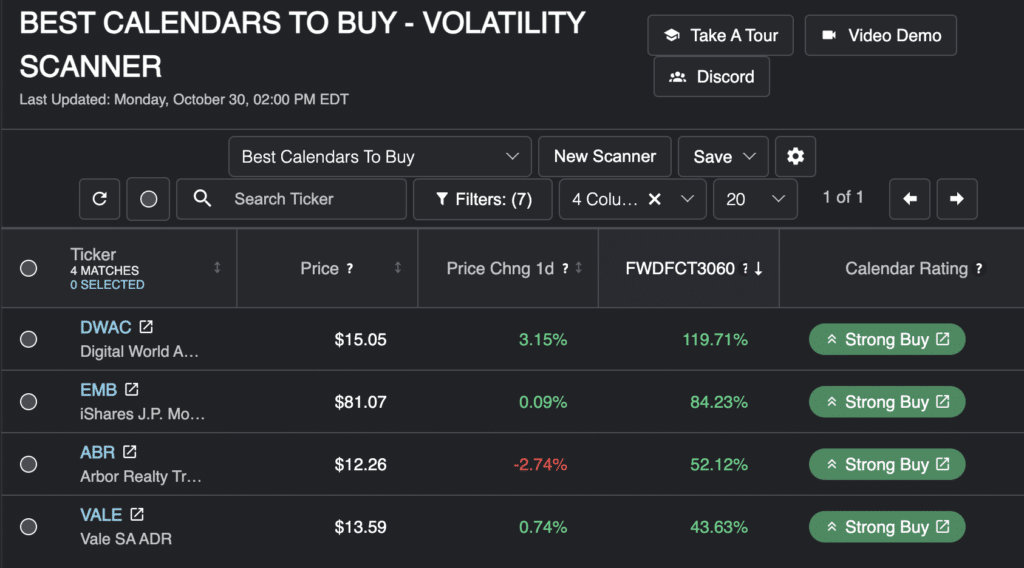

Best Calendars To Buy

What We Are Doing:

Selling expensive options and hedging it by buying cheaper options on the same ticker further out in time (a calendar spread)

Why It Makes Money:

This strategy makes money by identifying trades where there is a mispricing in the option premiums at different expirations for a ticker. This is done by using a signal called the forward factor that was developed by hedge fund manager Jim Campasano. This strategy has a very consistent and smooth PnL. There is a lot of research supporting it. To run this strategy effectively build up a portfolio of these calendar spreads. Buy a calendar spread on all tickers on this scanner that have a forward factor greater than 16%.

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Long calendar spreads

Trade Management Tips

Make sure to allocate an even amount of capital to each trade. Always check the forward factor of the fills you are getting in your brokerage (you can check using the calculator on the Calendar Report Page) and close the trade when the first expiration is 3-5 days away.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

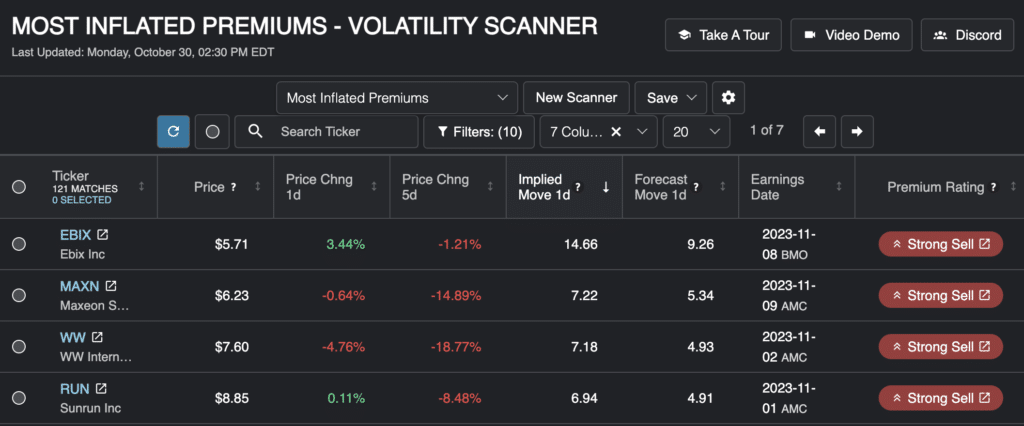

Most Inflated Premiums

What We Are Doing:

Selling option premiums on the most dangerous tickers since they have the largest embedded risk premiums.

Why It Makes Money:

We do not sell premium on just one volatile ticker. We do it on a basket of them. This allows us to allocate a lot of our capital to selling highly volatile option premiums without taking on the risk that any individual ticker moves a lot. This scanner finds trades by looking for tickers where the IV percentile for all of the option experiences is above 65%.

This means the all options are very expensive. If we can see that the option premium is driven by news, short squeezes, or wall street bets, they are great candidates for selling a small amount of options as a part of this strategy. This strategy is expected to generate massive returns on an annual basis.

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Short straddle

- Short iron condor

- Bull Put Spreads

- Short Puts

- Cash Secured Puts

Trade Management

Stress each trade to a 100% of option premium loss. This will also be your stop loss. Use the premium tracker to determine the fair value for option premiums and close out your trade for a profit if the options reach this price.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

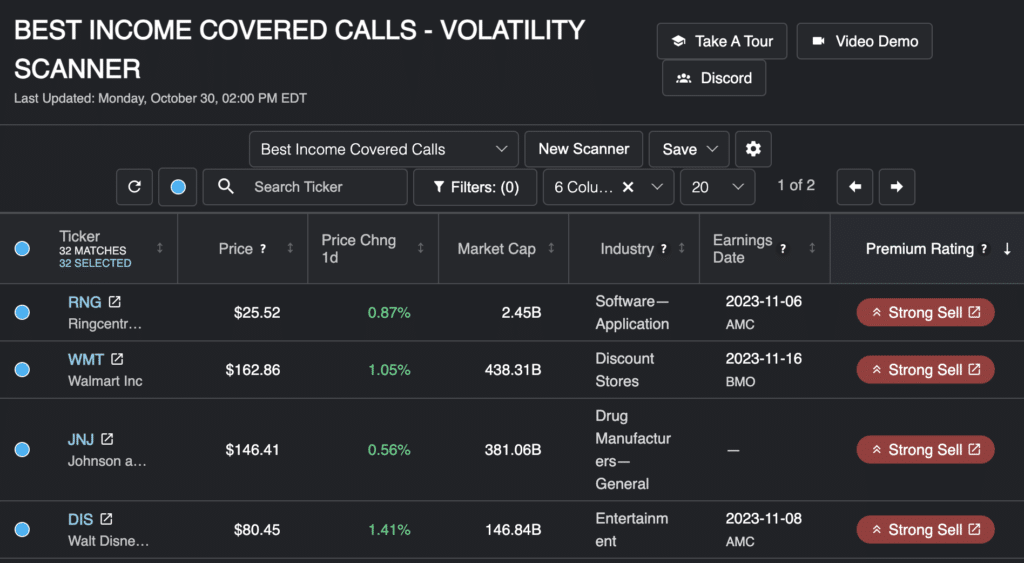

Best Income Covered Calls

What We Are Doing:

Selling options on high quality stocks with expensive option premiums to generate income.

Why It Makes Money:

We can like a stock and still think options are expensive. If you are looking for a long equity position to hold where you can also generate some cash flow, you want to sell calls on stocks that a) you like and think will go up in value over time b) the market is pricing the options to be more expensive than what they should be. Simply put, you think the stock will go up, but not with the velocity that the market implies. To run this strategy effectively you want to pick tickers from this list that you believe will increase in value over time and then sell 30-45 DTE OTM calls. Over time, you will build up a book of these trades and rebalance monthly.

Trader Profile:

Trade Stuctures:

This scanner is effective for the following trades:

- Covered call

Trade Management Tips:

Treat this as if you are holding stock (with a volatility component). Have a stop loss on the downside, but also close out when volatility drops below/ gets close to the forecast. No delta hedging required.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

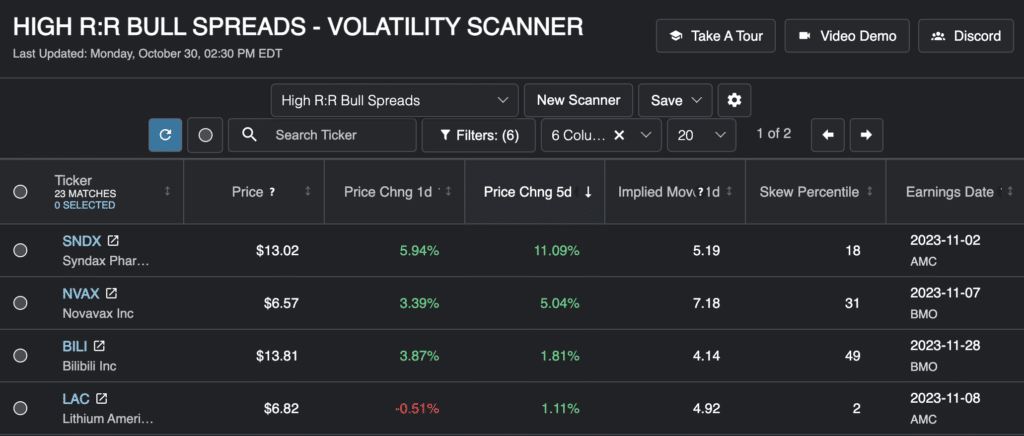

High R:R Bull Spreads

What We Are Doing:

Taking advantage of option market dynamics to place high reward, low risk bullish trades.

Why It Makes Money:

Stocks trend up, and explode down usually. When a stock gains a lot of hype, or has some positive news come out, the demand for calls begins to increase. This causes them to become increasingly expensive, as if the stock is going to explode to the upside. Since we know they usually trend up, and that the news has already come out, we can take advantage of the markets view here, bet on the stock trending up and get a huge risk/reward payoff if we are right because market overprices the big move up in these cases.

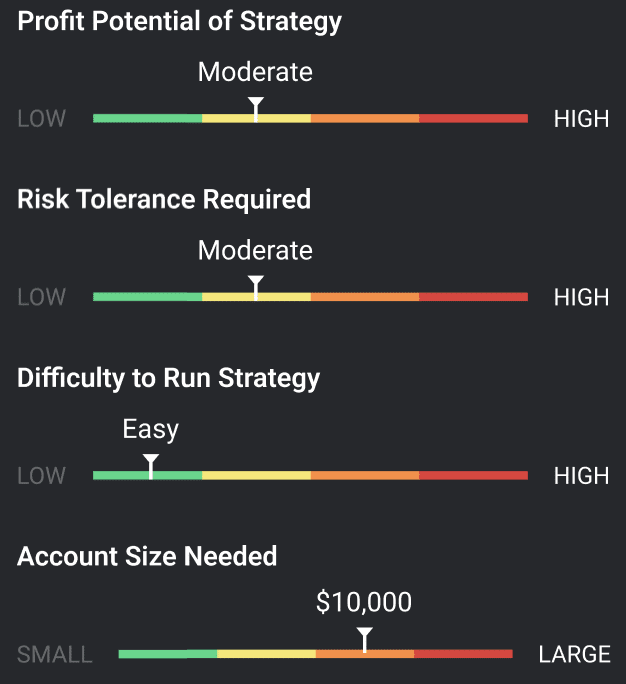

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Call Debit Spreads

- Unbalanced Call Fly

Trade Management Tips:

Trade management for this strategy is quite discretionary. Size the trade to a maximum of 3% of account max risk. if the stock moves down a lot, close out the trade. If the value of your spread decreases by 60%. close out the position.

Note: Trade management tips are generated in your trade reports by showing a future simulation of trade outcomes.

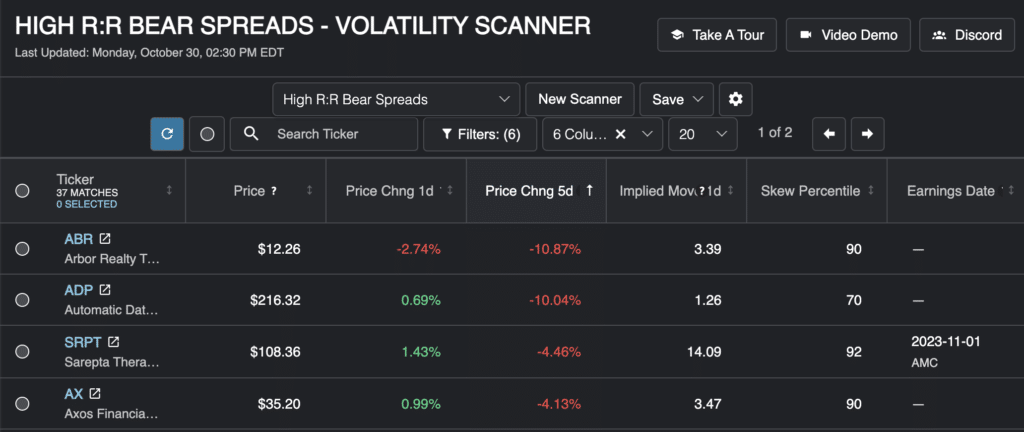

High R:R Bear Spreads

What We Are Doing:

Taking advantage of option market dynamics to place high reward, low risk bearish trades

Why It Makes Money:

Sometimes a company is on the decline, and the market prices in that the stock will plummet when in reality it is more likely to trend down. An example of this is when a stock releases bad news, or misses a milestone. When this happens, the demand for puts begins to increase. This causes them to become increasingly expensive, as if the stock is going to crash. We can determine when this is unlikely to happen, and then take advantage of the market panic. We do this by betting on the stock simply trending down, and we get a huge risk/reward payoff if we are right because the market overprices the big move down in these cases.

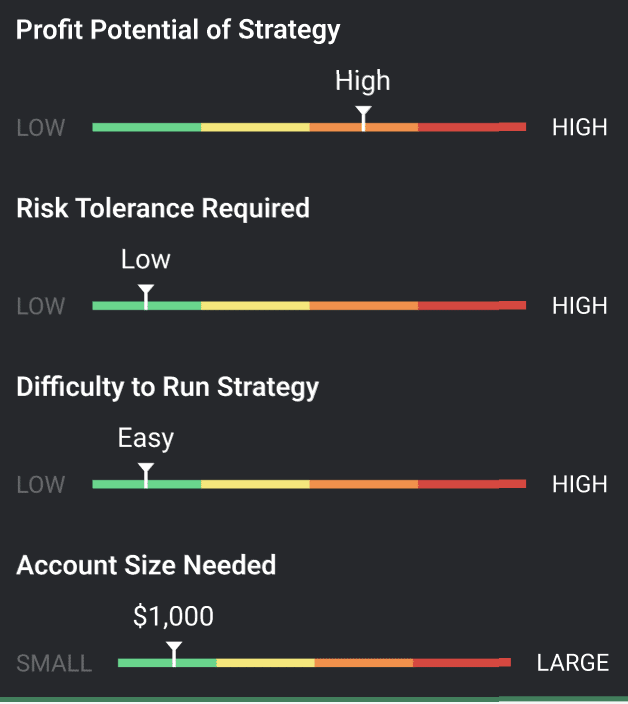

Trader Profile:

Trade Structures:

This scanner is effective for the following trades:

- Put Debit Spread

- Unbalanced Put Fly

Trade Management Tips:

Discretionary. Size the trade to a maximum of 3% of account max risk. if the stock moves down a lot, close out the trade. If the value of your spread decreases by 60%. close out the position.

Conclusion

All of these strategies are immediately available to you in the PA Terminal. Sign in, pick a strategy and start finding better trades today.

If you need assistance, feel free to send me an email to sean@predictingalpha.com. I will be happy to help.

Happy Trading,

Sean & The PA Team