When you are running an option selling business, it is very similar to selling insurance. Most of the time, you are going to collect premiums from you customers. Life is going to be all sunshine and rainbows. But once in a while, someone is going to crash their car. Or hurricane damages some houses. When these things happen, the insurance providers need to pay.

Bringing this back to the options world, most of the time when we are collecting premium we are going to be pretty happy with the results. Most of our trades are going to be profitable and our account profit and loss graph (PnL) will be going up and to the right.

But there will be periods where things will go against us and we will take a significant drawdown.

Why does this happen?

Because the entire reason we have been able to collect premiums is because everyone else is fearful of this risk. Others pay us this premium and in exchange, we take on this risk for them. The same way insurance companies operate.

In this article I am going to cover the basics of understanding this risk and premium relationship, how to gauge if you rewards are worth your risk and ways you can mitigate it.

Option selling VS option buying.

When you are trading options all positions and strategies can be boiled down to two things. Long volatility and short volatility.

Long volatility is what we call it when you run a strategy that involves you buying more options than you sell. The nature of these strategies is that they have many small losers, and the occasional big winner. You make money if your occasional big winner outpaces the small losers.

An example of a long volatility strategy that could be profitable is if you did research into small cap tech companies and found a signal for when they are more likely to have large moves in the next 30 days. You then buy straddles on a basket of tickers that meet this criteria and if your signal is accurate, the tickers which have big moves will outweigh the cost of the losses taken by buying straddles on the ones that didn’t.

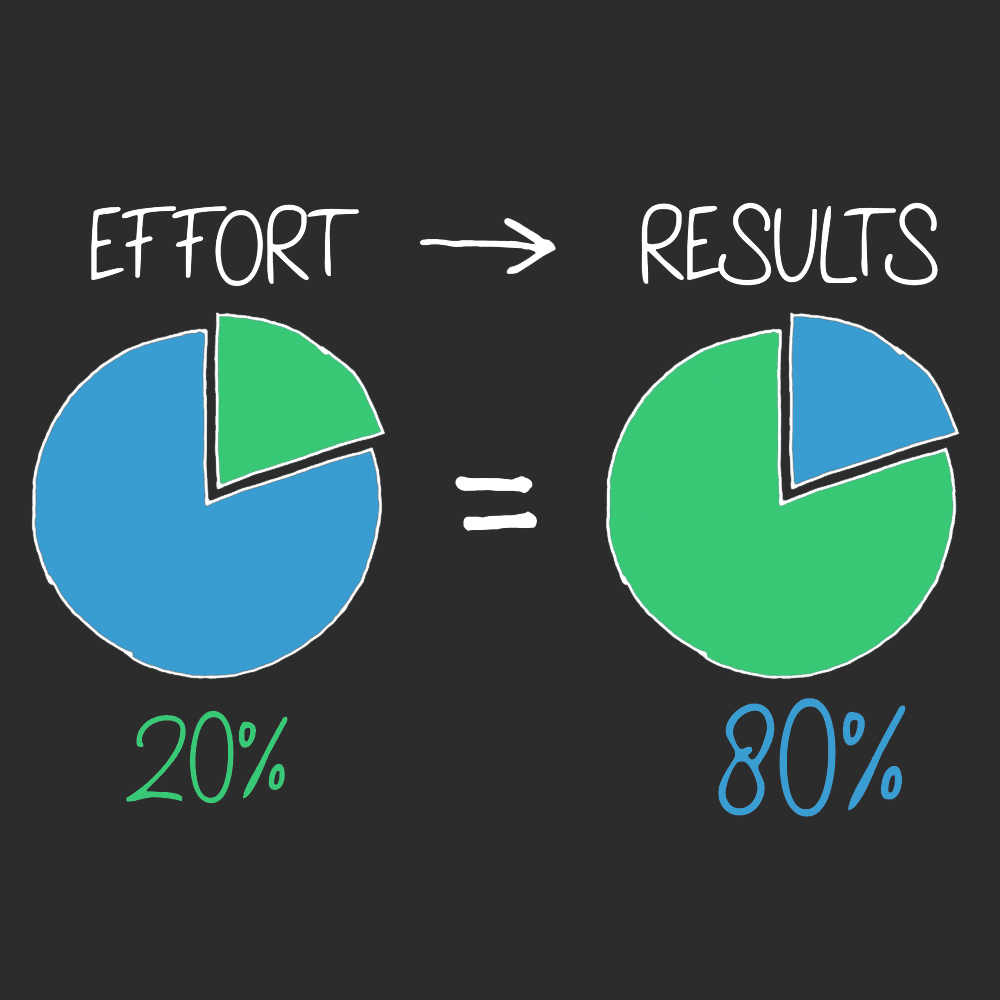

Short volatility is what we call it when you run a strategy that involves you selling more options than you buy. The nature of these strategies is that they have many small winners, and the occasional big loser. You make money if your many small winners outpace your occasional big loser.

An example of a short volatility strategy that could be profitable is selling options around earnings events. Since tickers tend to see big mopves around earnings, the price of options goes up a lot when there is an earnings event. Since everybody wants to buy optiosn here (hedge positions, bet on big moves) the option premium needs to go up enough to offset that risk for option sellers, resulting in a larger than normal premium. In this case, you make money if the increased premiums you collect outweigh the times when tickers have much larger than expected moves.

Ok, that is cool to know, but what does this have to do with current market moves?

Recently we have seen the market take a bit of a hit. Over the last month, the S&P is down about 5%, and vix is back up near $18.

What this means is that in recent times we have seen higher volatility than normal, and for those of us who are running a short volatility strategy, we are starting to see some losses on your book and it can be a bit nerve wracking.

It’s during times like this that we need to really understand the core reason we have been getting paid all along. It’s because when things start to get rocky, we are the ones who pay out. We collect our premiums during all the good times, and have to pay out during bad times.

The hard part for us though is that we don’t necessarily know if the bad times are just getting started, or if this is just a small bump in the road.

Thats why we need to be really clear on our strategy and why we are getting paid. If we aren’t clear on this and if we haven’t made peace with there being scenarios where we lose money, we end up trying to time the market in ridiculous ways and getting burned on both sides (taking the losses and missing the gains).

What can we do about it?

There are really three things that we can do:

The first is that we need to really make peace with the fact that there is no free money inn the market and the reason we have been getting paid is because we are holding on to risk. There will be times where we need to pay out, and it’s not necessarily a bad thing. In fact, it’s these times where we need to pay out that allow for us to have the times that we get to harvest a consistent risk premium (example: no one would buy insurance if there were never car accidents).

The second is that we need to have a clear idea of what is to be expected. How much money should we be making on average? What drawdown should we expect? These are important questions for us to at least think about because it can help us keep track of what we are seeing in the market and know if we are seeing something truly out of the ordinary which might signal to us a fundamental change in the way our strategy is running. For example, if you are running a short volatility strategy and based on your historical analysis you should not see a drawdown of more than 15%, then you have a good guage of when to “pull the plug” on your strategy. If all of a sudden you have a 20% drawdown, you know that you are seeing something outside of what you expect and you can stop running the strategy, potentially saving you from even bigger drawdowns. Then you go back into the lab and try to figure out what happened.

The third and final thing I suggest for you to consider doing is finding a way to hedge you position for as cheap as possible. The holy grail in option trading is to have both short volatility and long volatility strategies that are both positive expectancy (both actually make money in the long run). But if you are an option seller, even finding opportunity to buy options to relatively cheap can be worthwhile. Most of the time, these options will expire worthless, but occasionally, they will turn a big profit and come in handy because this is often the times when your option selling trades will be doing poorly.

Just do simple things that make money over time.

I hope that by this point you are pretty clear on the idea that there is no free money and when we are getting paid in the market it’s usually for holding risks that someone else is trying to avoid.

Once we have come to terms with this, we can start to view our strategies from a less emotional charged place and make better decisions. Trading is a volatile game and we need to be able to do this if we want to win. If you can’t do this then you could literally be running a highly profitable strategy and still lose money because any time there is a drawdown, you will be changing the strategy. On the flip side, if you can view your strategy objectively, you will be able to survive the variance and realize the rewards that await on the other side.