The Ultimate Earnings Options Strategy – Selling Options Like a Professional

Variance risk premiums often arise around market events that could lead to significant price changes in stocks. Examples include earnings reports, FOMC meetings, and product releases. These events can trigger substantial price movements, offering considerable returns to those providing liquidity to option buyers during these times. One of the most popular event-driven trades among Predicting […]

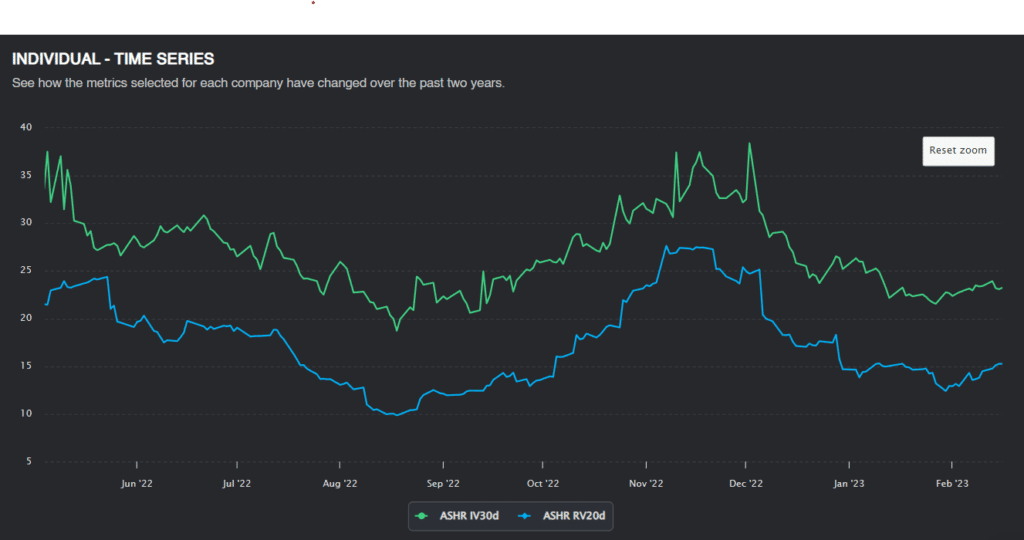

Finding Expensive Options To Sell – Calculating the Variance Risk Premium in 2024

For a long time there was a big edge in putting together your own model for volatility and trading when it was different from the market. But in recent years, the market has become a lot better at forecasting volatility. The odds of us putting together a vol targeting forecast that beats the market on […]

The Key to Profitable Option Selling: A Guide to Exploiting Variance Risk Premium

Introduction to the Variance Risk Premium The variance risk premium is the observed historical difference between implied and realized volatility. In simpler terms, it’s the premium options trade at above their fair value. Selling options can be a profitable strategy because they offer buyers unlimited profits and limited downside. This attractive return profile means the […]

Relative Value Volatility Trading

Introduction In a Flirting With Models podcast, Benn Eifert, founder of hedge fund QVR advisors, discusses “volatility investing.” Benn outlines the fundamentals of relative value, why it works, and its applications to volatility trading. He also explains how volatility traders develop strategies, looks for trade ideas, and his worldview on the relative value volatility trader’s […]

Market Neutral Options Trading Strategies

Introduction Directionally neutral trading strategies are becoming increasingly popular among options traders. These strategies are based on the volatility of an underlying stock, rather than the price of the stock itself. With these strategies, traders can capitalize on the price movements of stocks without having to predict their direction accurately. In this article, we will […]

The Wheel: Options Strategy Guide

Introduction: What is The Wheel? The wheel strategy involves two trades: the cash-secured put (CSP) and the covered call (CC). This is a popular trading strategy used by beginner options traders. It’s so popular, in fact, that there are entire communities (such as the ThetaGang subreddit) where the wheel is their main strategy. Here’s how […]

Professional Skew Trade Breakdown

Introduction I recently revisited this post by u/Fletch71011, which talks about a trade he made in Soybean Meal options. I remember how difficult it was for me to read when I first came across this breakdown; I would’ve wanted someone to help break down difficult concepts so I could better understand the trade. Now that I think I […]

Options 101: A Beginner’s Guide to Options Trading

Article Summary: What Is A Call Option? A call option is a financial instrument that gives the holder the right to purchase 100 shares of a specified stock at the expiration date and strike price chosen. If the stock price exceeds the strike price, you can buy it for less than the current market value. […]

The Options Trader’s Guide to Evaluating Trades

Article Summary: Introduction When it comes to gauging your trading capabilities, there are two approaches: evaluating them by the results of your trades or by assessing your methodology. It is essential to understand that there is a lot of variance in each trade, no matter how experienced you might be. Therefore, evaluating yourself based on […]

The Option Trader’s Guide to the Variance Risk Premium

Article Summary: What is the Variance Risk Premium? The variance risk premium (VRP) concept describes how implied volatility tends to be greater than the subsequent realized volatility. This phenomenon presents an excellent opportunity for those willing to accept the risk of selling volatility by writing options contracts and collecting premiums. In the September/October 2015 issue […]

The Greeks: A Guide for Options Traders

Article Summary: Introduction While stock investors only have to deal with the risk of falling stock prices, options traders have many other risks. Because options are more complex than stocks and other delta-one products, options traders had to develop various measures of risk: the Greeks. The Greeks are risk measures that describe how an option’s […]

The Option Trader’s Guide to Volatility Trading

Article Summary Introduction Volatility trading is a type of options trading that uses market volatility to make a profit. Instead of betting on the direction of a stock, they bet on how big the fluctuations in market price will be. For many market makers and quant funds, volatility trading is the core of what they […]