The Key to Profitable Option Selling: A Guide to Exploiting Variance Risk Premium

Introduction to the Variance Risk Premium The variance risk premium is the observed historical difference between implied and realized volatility. In simpler terms, it’s the premium options trade at above their fair value. Selling options can be a profitable strategy because they offer buyers unlimited profits and limited downside. This attractive return profile means the […]

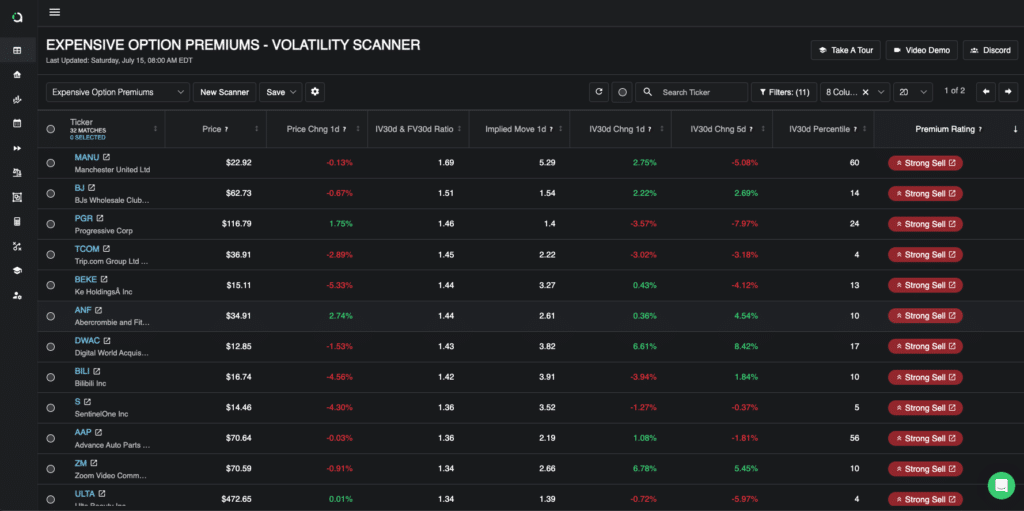

Five Pre Built Option Strategy Scanners That Profit From Volatility Inefficiencies

Option trading is all about finding cheap volatility to buy, and expensive volatility to sell To make this easier for you, we have 5 pre built scanners in the Predicting Alpha terminal which allow you to quickly sort the market to find opportunities that most traders can’t find. With each of these scanners, you are […]

Why Would Anyone Share Their Trading Strategies?

Every trader dreams of finding the secret formula for making consistent profits in the market. And while it may seem counterintuitive, many successful traders are willing to share their strategies with others. So why would they do that? One important concept to understand in the context of trading strategies is the difference between beta and […]

What I learned from Citadel’s Training Software

Introduction When I was a Finance undergrad, one of the classes I most looked forward to was Financial Trading Strategies. While other classes were more academic with textbooks and PowerPoint slides, our professor was a former market maker who taught us through hands-on experience. Throughout that semester, our professor gave us — using the same […]

Relative Value Volatility Trading

Introduction In a Flirting With Models podcast, Benn Eifert, founder of hedge fund QVR advisors, discusses “volatility investing.” Benn outlines the fundamentals of relative value, why it works, and its applications to volatility trading. He also explains how volatility traders develop strategies, looks for trade ideas, and his worldview on the relative value volatility trader’s […]

How To Learn Trading

Article Summary Introduction When a new trader asks for advice on how to start trading, we often become too focused on a new trader’s technical skills. We try to teach traders how to enter and exit positions, options theory, and risk management. However, this is not always a practical approach. If you’ve read psychologist Dr. […]

The Business of Trading

Article Summary: Introduction Listening to many interviews with options fund managers gave me insight into how these traders approach the market and make decisions. As with any other business venture, options traders must understand their industry, why their business can be profitable, and where to set up shop. This has completely changed the way I […]

The Options Trader’s Guide to Evaluating Trades

Article Summary: Introduction When it comes to gauging your trading capabilities, there are two approaches: evaluating them by the results of your trades or by assessing your methodology. It is essential to understand that there is a lot of variance in each trade, no matter how experienced you might be. Therefore, evaluating yourself based on […]

What Poker Can Teach You About Options Trading

“Gambling, noun. The practice or activity of betting : the practice of risking money or other stakes in a game or bet.“ Merriam-Webster Dictionary Article Summary: There’s A Reason Many Professional Traders Also Play Poker. Many poker players and options traders hate it when we refer to either as “gambling”, but even though they’re games of skill, […]

The Comprehensive Guide to the Covered Call Option Trading Strategy

Introduction Covered call writing is an investment strategy that can be used to generate income from a bullish market. By buying a stock and simultaneously selling a call option on the same stock, investors can earn premiums which can then be used to offset any losses incurred should their stocks decline in value. However, it […]

The Comprehensive Guide to Trading Options on Blue Chip Stocks

Introduction Options trading strategies, such as credit spreads, calendar spreads, straddles, strangles, and iron condors offer investors a variety of ways to gain exposure to stocks. Each options strategy carries different levels of risk and reward depending on the situation, but each are useful depending on market conditions. In this article, we will discuss the […]