The Ultimate Option Selling Strategy – A Boring But Profitable Method That Actually Makes Money

In this article I am going to teach you the most effective way to make money as an option seller. Before we dive in though

In this article I am going to teach you the most effective way to make money as an option seller. Before we dive in though

Manage your emotions. More time on the charts. You got greedy. There are a million and one reasons to blame yourself for your trading strategies

By the end of this article you will know the pros and cons of trading straddles versus strangles. Structures are the tools option sellers use.

Our new homepage is launched and it shows you the top stocks and ETFs for selling options. New features overview Click here to watch a

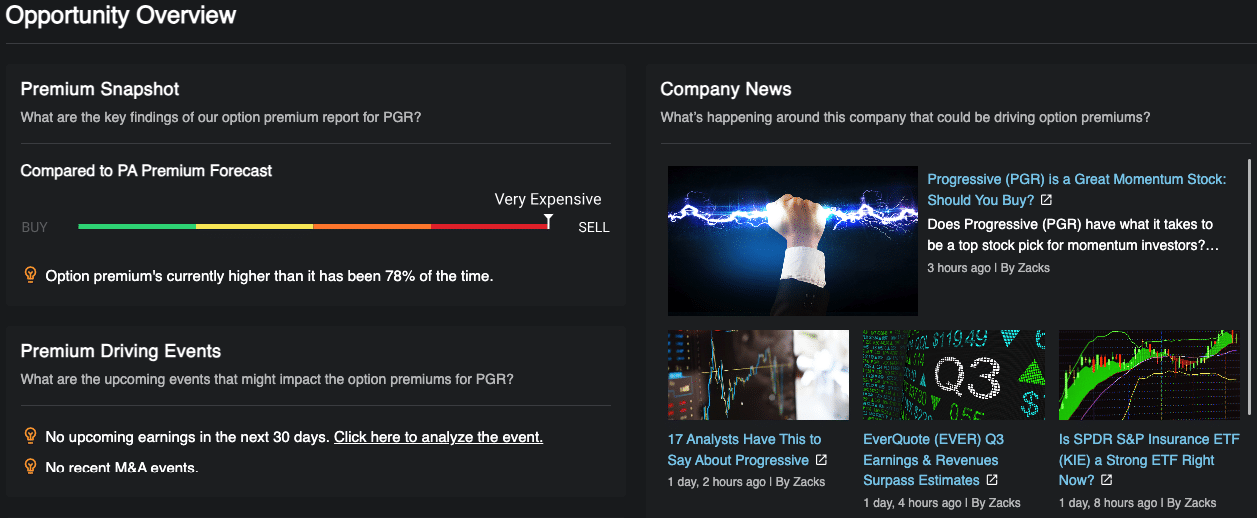

For a long time there was a big edge in putting together your own model for volatility and trading when it was different from the

We are very excited to release 5 new metrics that will help you measure the Variance Risk Premium for any ticker. Along with this update

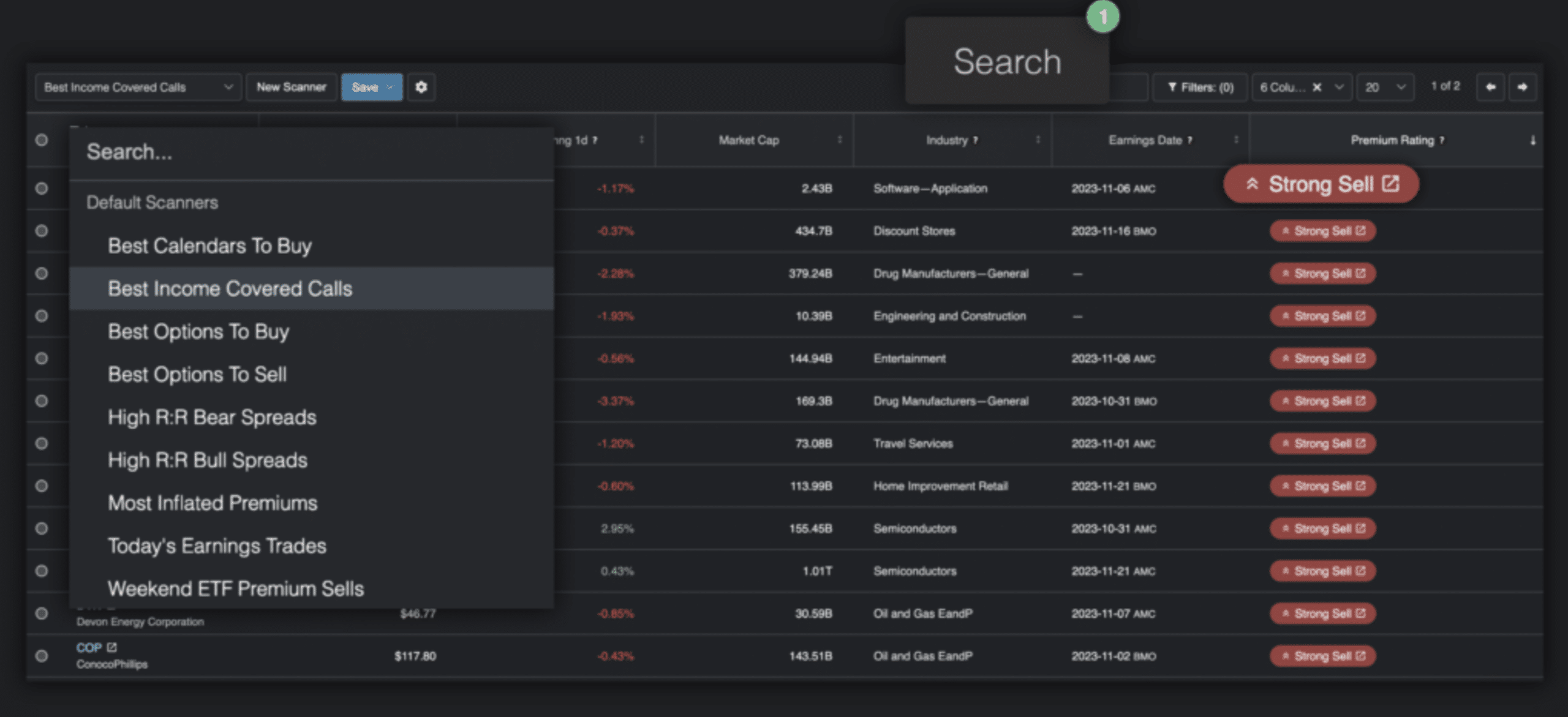

When it comes to finding and placing excellent trades there are three basic steps that you need to follow. Up until now the Predicting Alpha

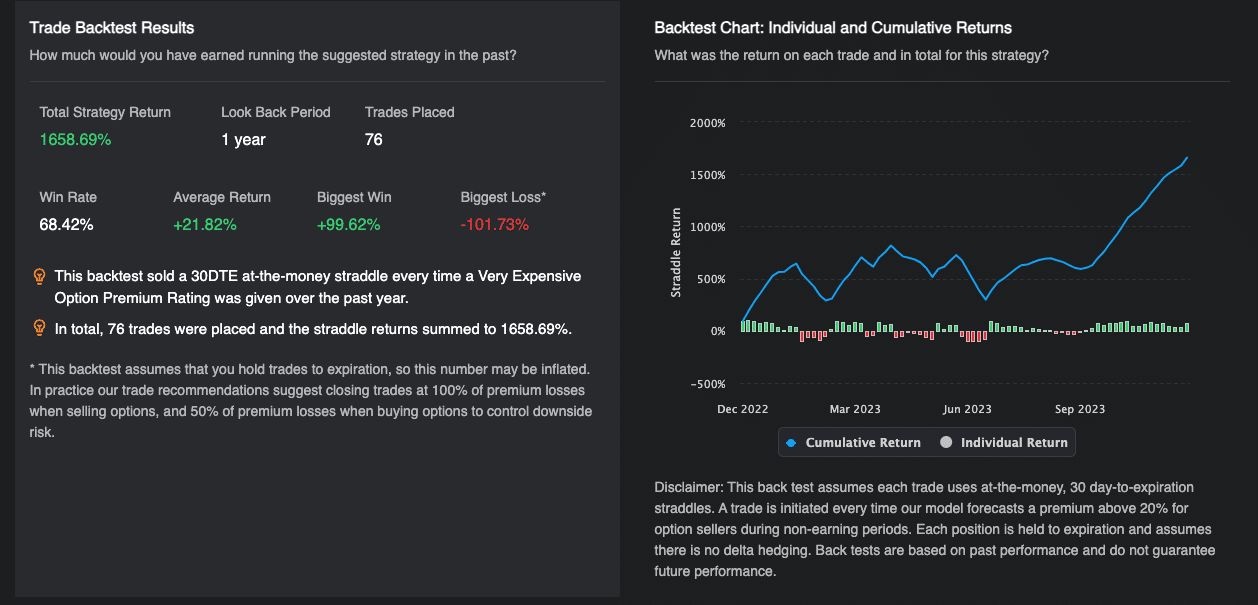

Every trader has one question that they wanted answered when they find an option trade. “Has doing this made money in the past?” That’s why

One of the big reasons traders use Predicting Alpha is to find data-driven trades (shocker, I know). Today we made that easier by launching 9

Our team realized something recently that changed the way we thought about option trading. Remember the process we taught in our Ultimate Guide to Selling

Introduction to the Variance Risk Premium The variance risk premium is the observed historical difference between implied and realized volatility. In simpler terms, it’s the

When you are running an option selling business, it is very similar to selling insurance. Most of the time, you are going to collect premiums