$224,914.81 Profit Across 1,381 Trades: A Live Breakdown of Earnings Strategy Returns

We are going to analyze two years of running the earnings strategy live. This journal was provided to us by a long time Predicting Alpha member, Jay, who meticulously tracked every single trade he took while running the Earnings Premium Strategy since October 2022. Jay made $224,914.81 and a 89.97% return in two years while […]

Expensive Options Case Study: TSM

This is a simple trade that will make around 1% in a month. Here is my research: What is TSMC? TSMC is a semiconductor manufacturing company with huge companies such as AMD, Apple, NVIDIA, and more as its clients. Here’s how the stock has been moving recently: While the stock made an impressive run in […]

EWT Trade Analysis: Foreign VRP

During my daily options scan, I found a trade that should return 2% on your margin this month. Here is my analysis. What is EWT? EWT tracks the investment results of an index composed of Taiwanese equities. Here’s how the price has moved recently: While we saw a bit an extended run in early January, […]

SLG Trading Case Study: Empty Office Buildings?

This trade could return 3.5% on margin over 35 days. Here is my analysis. What is SLG? According to Yahoo Finance: “SL Green Realty Corp is an investment trust focused primarily on Manhattan commercial properties. As of December 31, 2022, SL Green held interests in 61 buildings totaling 33.1 million square feet. This included ownership […]

COP Trade Analysis: Temporarily Expensive Options

I found a trade that should earn a 2% return on margin in 37 days. I noticed this opportunity during my daily expensive options scan. Here’s my analysis of this trade. What is COP? ConocoPhillips is an American multinational energy corporation in the oil and gas industry. The company is one of the world’s largest […]

GLD Trade Analysis: Expensive Risk Premiums

The core business of almost every trading operation should be based on risk premia. Right now, GLD makes for a VRP trade that should earn 0.75% within ten days. Overview of GLD GLD is an ETF that tracks the price of physical gold. Its only holding is a vault with gold bars, probably somewhere safe […]

Expensive KWEB Options: Trading Case Study

I found a trade that should earn a 1.7% return on margin in 11 days. I first noticed this ETF during my daily expensive options scan. Here’s my analysis of this trade. What is KWEB? KWEB tracks the CSI Overseas China Internet Index. The Index includes publicly traded securities on the Hong Kong Stock Exchange, […]

Post Earnings Trade Analysis: EXPE + ETSY

Everyone knows that after an earnings announcement, IV Crush demolishes the prices of options. However, for EXPE and ETSY, prices after earnings were still too expensive. To start, here’s how I found these trade opportunities: Ran an expensive options scan. Looked for Post Earnings Volatility After earnings results are released, there’s no longer any uncertainty, […]

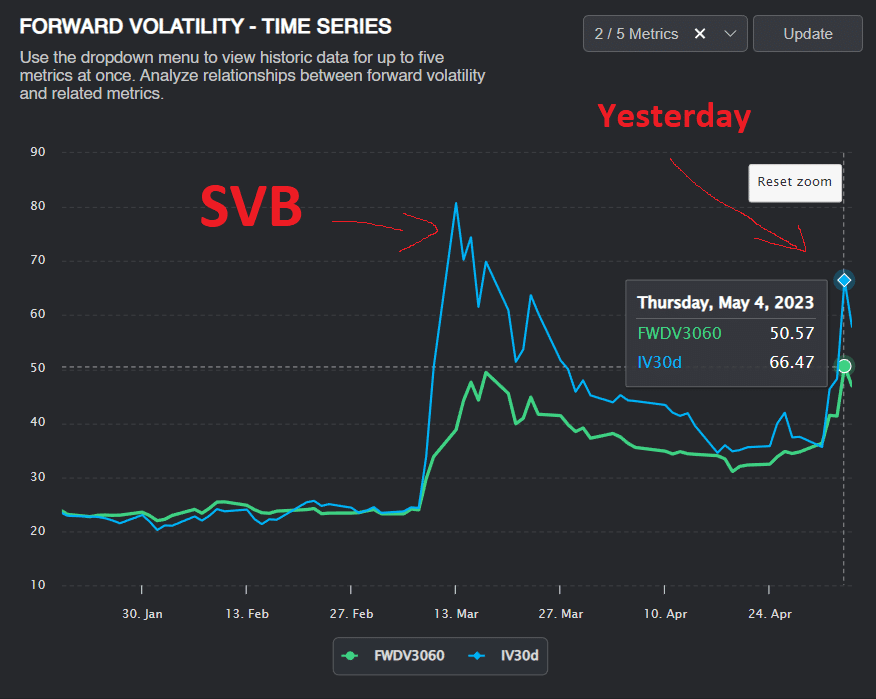

KRE – Is It Crashing Yet? Calendar Trade Analysis

A while ago, I wrote about a calendar trade I put on when Silicon Valley Bank was collapsing. Because of the market panic, weekly options were extremely expensive relative to monthly options. The market was pricing in huge moves in the short term but very little in the long term. This week, the same trade […]

Earnings Disasters: TGT Trade Analysis

This post goes over how I think through my trades. I wanted to share this trade because the edge was clear, and it’s a good example to learn from. However, we need to start from the beginning to understand how to think through trades like these. I’ll give you the context for this trade – […]

KRE: A Case Study in Forward Volatility

Introduction Forward volatility trading can be an extremely lucrative strategy. In this article, I will walk you through my personal journey of identifying and executing a forward volatility trade last month using calendar spreads. Inspired by Professor Jim Campasano’s research, we’ll explore how the market’s volatility expectations throughout time created a lucrative trading opportunity. I […]

Relative Value Volatility Trading

Introduction In a Flirting With Models podcast, Benn Eifert, founder of hedge fund QVR advisors, discusses “volatility investing.” Benn outlines the fundamentals of relative value, why it works, and its applications to volatility trading. He also explains how volatility traders develop strategies, looks for trade ideas, and his worldview on the relative value volatility trader’s […]