Finding Expensive Options To Sell – Calculating the Variance Risk Premium in 2024

For a long time there was a big edge in putting together your own model for volatility and trading when it was different from the market. But in recent years, the market has become a lot better at forecasting volatility. The odds of us putting together a vol targeting forecast that beats the market on […]

Trading Methodology Update + New Metrics for Finding Inflated Option Premiums

We are very excited to release 5 new metrics that will help you measure the Variance Risk Premium for any ticker. Along with this update comes a methodology that is based on building a solid foundation for your portfolio, then spending time looking for unique situations that offer outsized returns. Some background information on this […]

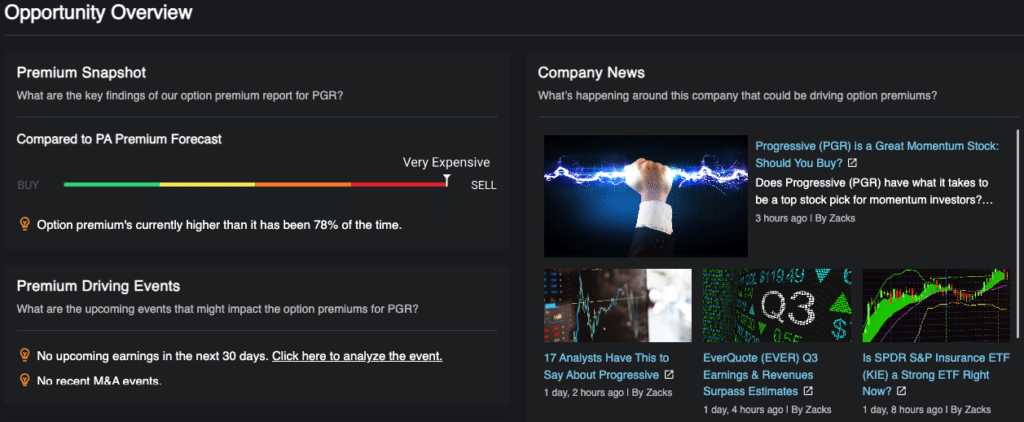

Sell Options With Context: Option Premium Reports Now Source The Most Relevant News For You

When it comes to finding and placing excellent trades there are three basic steps that you need to follow. Up until now the Predicting Alpha Terminal has helped you execute step 1 and step 3 with precision. But our members have been forced to comb through dozens of articles in other places to find the […]

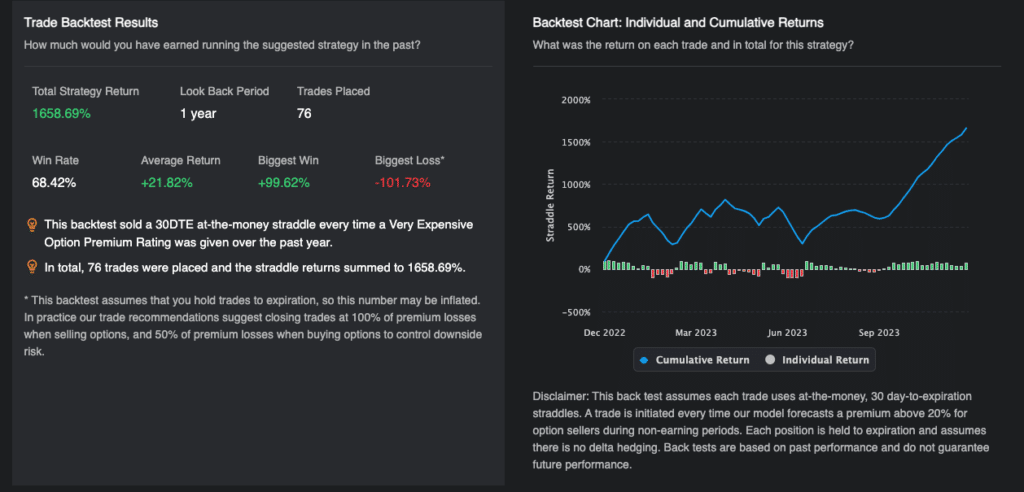

Backtest Option Selling Strategies For Any Ticker Instantly With The Predicting Alpha Terminal

Every trader has one question that they wanted answered when they find an option trade. “Has doing this made money in the past?” That’s why we are happy to introduce our backtesting feature, which is included in every Option Premium Report you generate the PA Terminal. How does the backtest work? The backtest is a […]

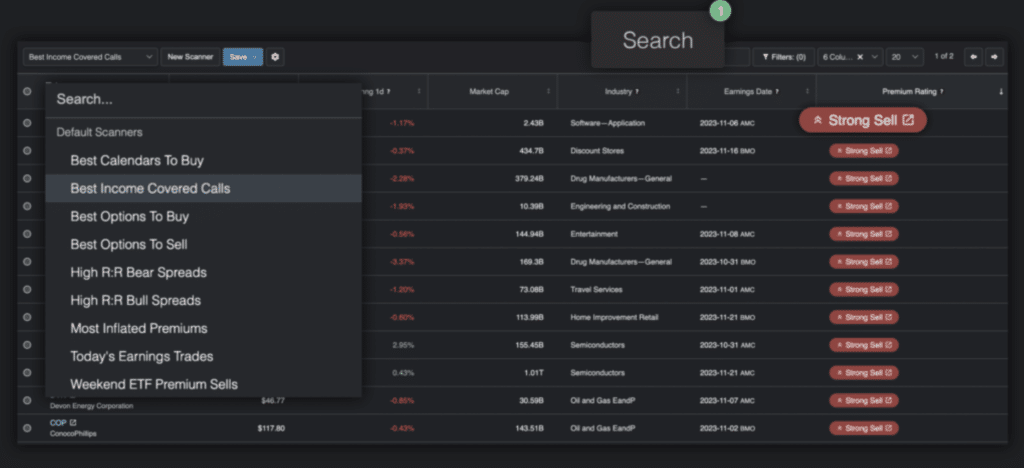

Trade Nine Out-Of-The-Box Option Premium Strategies Using The Predicting Alpha Terminal

One of the big reasons traders use Predicting Alpha is to find data-driven trades (shocker, I know). Today we made that easier by launching 9 new strategy trade scanners that you can use today. How to Access The Scanners: All of these strategies are pre-loaded for you on the scanner page. All you need to […]

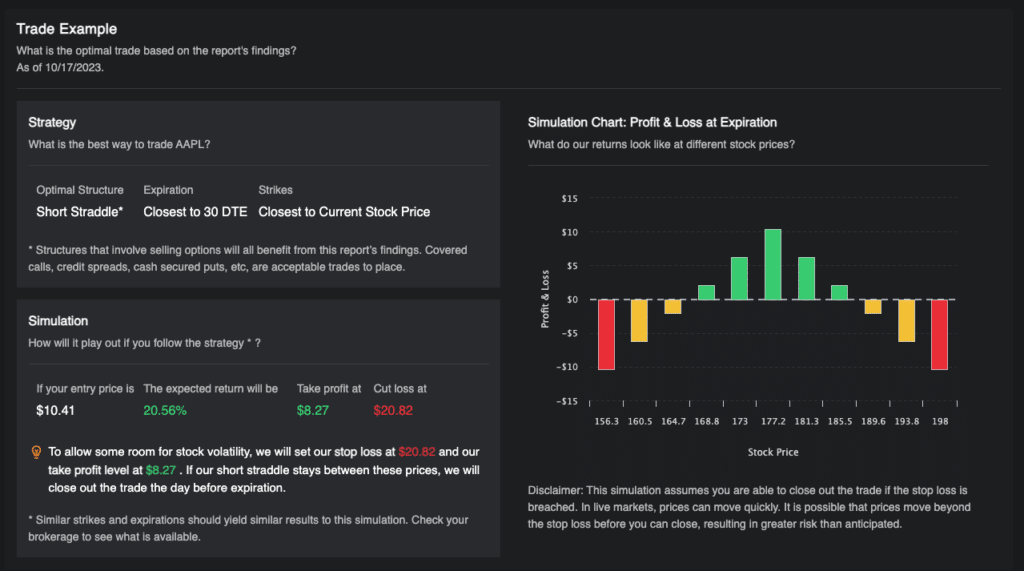

Option Premium Reports And New Strategy Scanners Are Now LIVE – Predicting Alpha Update October 2023

Our team realized something recently that changed the way we thought about option trading. Remember the process we taught in our Ultimate Guide to Selling Options Profitably? Literally 90% of that could be automated and the results could be given to you on a single page and in a way that is actually easy to […]

The Key to Profitable Option Selling: A Guide to Exploiting Variance Risk Premium

Introduction to the Variance Risk Premium The variance risk premium is the observed historical difference between implied and realized volatility. In simpler terms, it’s the premium options trade at above their fair value. Selling options can be a profitable strategy because they offer buyers unlimited profits and limited downside. This attractive return profile means the […]

Understanding Your Option Selling Strategy (Why It Makes Money, Why It Loses Money)

When you are running an option selling business, it is very similar to selling insurance. Most of the time, you are going to collect premiums from you customers. Life is going to be all sunshine and rainbows. But once in a while, someone is going to crash their car. Or hurricane damages some houses. When […]

Earnings is Over! BABA Case Study

A while ago, we interviewed MIT researcher Tim De Silva, who found that selling options after an earnings event tends to make money, because IV crush takes some time to materialize fully. Since BABA had just released earnings this morning, this stock is definitely one where we might be interested in selling vol. Before we […]

What Is Predicting Alpha?

When I first learned about options, I, like many other options traders I see on Reddit, would more or less blindly sell covered calls, cash-secured puts, and credit spreads on high IV stocks. Like many other traders I saw on Reddit, I lost a ton of money. However, I got lucky. Several years ago, I […]