Expensive Options Case Study: TSM

This is a simple trade that will make around 1% in a month. Here is my research: What is TSMC? TSMC is a semiconductor manufacturing

This is a simple trade that will make around 1% in a month. Here is my research: What is TSMC? TSMC is a semiconductor manufacturing

A while ago, we interviewed MIT researcher Tim De Silva, who found that selling options after an earnings event tends to make money, because IV

During my daily options scan, I found a trade that should return 2% on your margin this month. Here is my analysis. What is EWT?

This trade could return 3.5% on margin over 35 days. Here is my analysis. What is SLG? According to Yahoo Finance: “SL Green Realty Corp

I found a trade that should earn a 2% return on margin in 37 days. I noticed this opportunity during my daily expensive options scan.

The core business of almost every trading operation should be based on risk premia. Right now, GLD makes for a VRP trade that should earn

I found a trade that should earn a 1.7% return on margin in 11 days. I first noticed this ETF during my daily expensive options

Everyone knows that after an earnings announcement, IV Crush demolishes the prices of options. However, for EXPE and ETSY, prices after earnings were still too

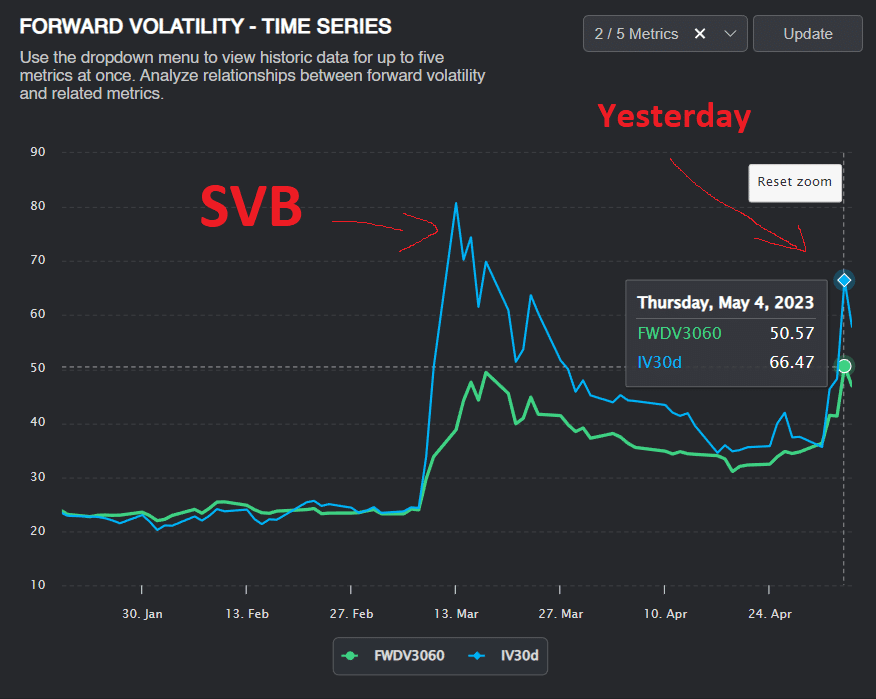

A while ago, I wrote about a calendar trade I put on when Silicon Valley Bank was collapsing. Because of the market panic, weekly options

When I first learned about options, I, like many other options traders I see on Reddit, would more or less blindly sell covered calls, cash-secured

This post goes over how I think through my trades. I wanted to share this trade because the edge was clear, and it’s a good

Introduction Forward volatility trading can be an extremely lucrative strategy. In this article, I will walk you through my personal journey of identifying and executing